Question: Critically evaluate the following scenarios and identify whether the statement is TRUE, FALSE or UNCERTAIN. Provide a brief explanation to support your answer. (a) Adverse

Critically evaluate the following scenarios and identify whether the statement is TRUE, FALSE or UNCERTAIN. Provide a brief explanation to support your answer.

(a) Adverse selection provides the explanation for why homes that have full insurance overage, but are in the same neighbourhood and otherwise identical, tend to have relatively higher incidence of accidental re damage compared to those without insurance.

Choose One: TRUE FALSE UNCERTAIN

Explanation:

(b) As an HR manager, you are planning to hire a software programmer on a one time basis for a programming job. The quality of the programmer is her private information, and you only know that 50% of the available programmers are good and the rest are bad. A good programmer will create a program with a value of $100,000 for the rm, but she signs only if she is paid at least $60,000. A good programmer will create a program with a value of $50,000 for the rm, and she signs only if she is paid at least $30,000. In order to maximize expected surplus for the rm, you should advertise the job with a compensation of $30,000 and hire the first qualified programmer who applies for the job.

Choose One: TRUE FALSE UNCERTAIN

Explanation:

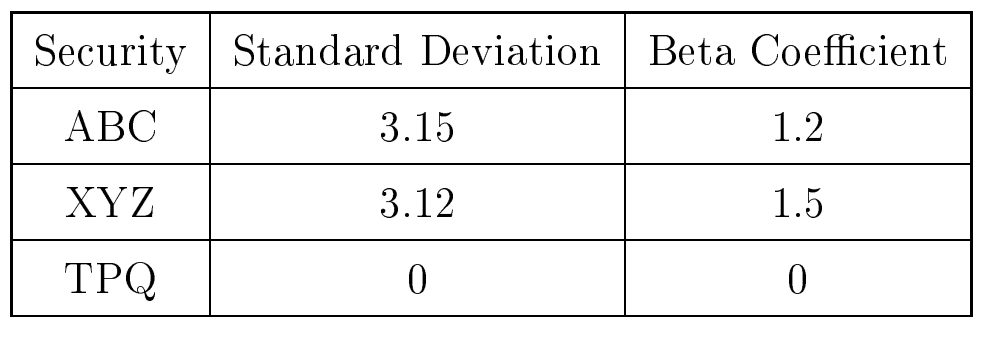

(c) From the information below, CAPM postulates that security ABC should have the highest and security TPQ the lowest expected return respectively amongst the three securities below

Choose One: TRUE FALSE UNCERTAIN

Explanation:

(d) A stock with beta of 1.5 and an expected return of 20% is undervalued according to CAPM, when the market risk premium is 12%.

Choose One: TRUE FALSE UNCERTAIN

Explanation:

Security Standard Deviation Beta Coefficient ABC 3.15 1.2 XYZ 3.12 1.5 TPQ 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts