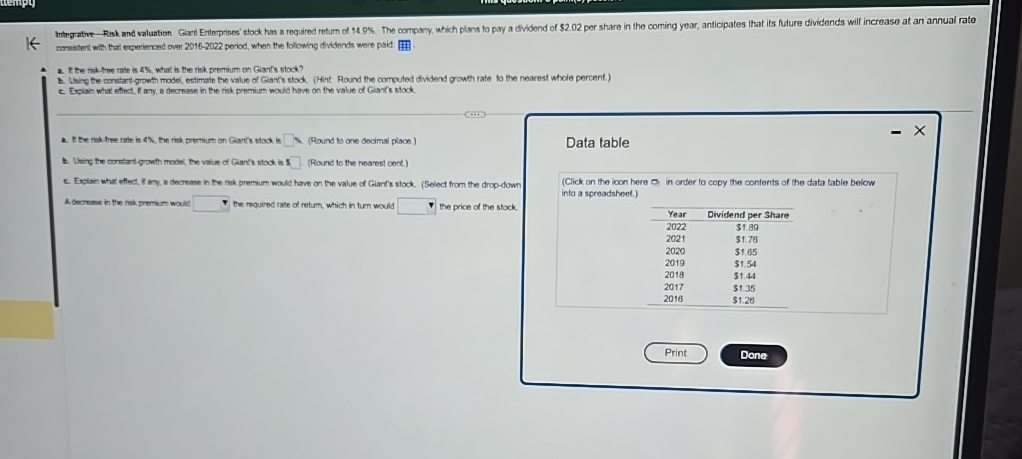

Question: crmestert with that eccerienced over 2 0 1 0 - 2 0 2 2 period, when the following dividonds were paid: . 2 . Ete

crmestert with that eccerienced over period, when the following dividonds were paid:

Ete tak hee rate is what is the risk premium on Gart's stoch?

b Wigg te constartgrowth model estimate the value of Garrs stack. Hint Round the computed dividend growth rate to the nearest whole percent.

c Explan what effect. I any, a decrease in the risk premium would have on the value of Gian's stock

It Te tha tree tale is h The frik premum on Cant's stock is Round to one decimal place.

Data table

B Uweg tre anclatigrowth model Me value Giarl's stod, inRound to the nowest cont.

C Explan what efect, If any, a decrease in the nid premium would heve on the value ot Giari's stock Select from the dropdown

A becrease in tre nisk premim wold the regured rate of return, which in turn would the price of the stock.

Click on the icon bere o in order to copy the contents of the data table beiow into a spreadsheet.

tableYearDividend per Share$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock