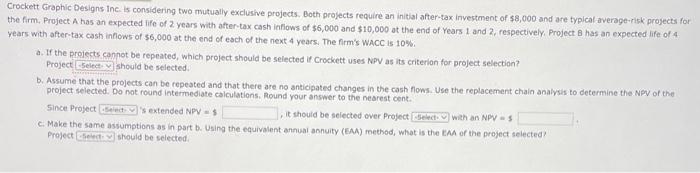

Question: Crockett Graphic Designs inc: is considering two mutually exclusive projects, Both projects require an initial after-tax investment of 58 , 000 and are typical average-risk

Crockett Graphic Designs inc: is considering two mutually exclusive projects, Both projects require an initial after-tax investment of 58 , 000 and are typical average-risk projects for the firm. Project A has an expected life of 2 years with after-tax cash infiows of $6,000 and $10,000 at the end of Years 1 and 2 , respectively, Project 8 has an expected life of 4. years with after-tax cash inflows of 56,000 at the end of esch of the next 4 years. The frm's Wacc is 10%. a. If the projects canpot be repeated, which project should be selected if Crockett uses NPV as its criterian for project selection? Project should be selected. b. Assume that the projects can be repeated and that there are no anticipated changes in the cash flows. Use the replacement chain analysis to determine the Nev of the project selected. Do not round intermediate calculations. Roynd your answer to the nearest cent. Since Project is extended NPV =5, it thould be selected over Project wath an NPV = 5 c. Make the same assumptions as in part b. Using the equivalent annual annuity (EAA) method, what is the EAA of the project selected? Project should be selectedi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts