Question: Cryo Ltd started trading on 1 September 2019. It makes both standard and zero rated supplies. Sharon, the new tax director of Cryo Ltd, requires

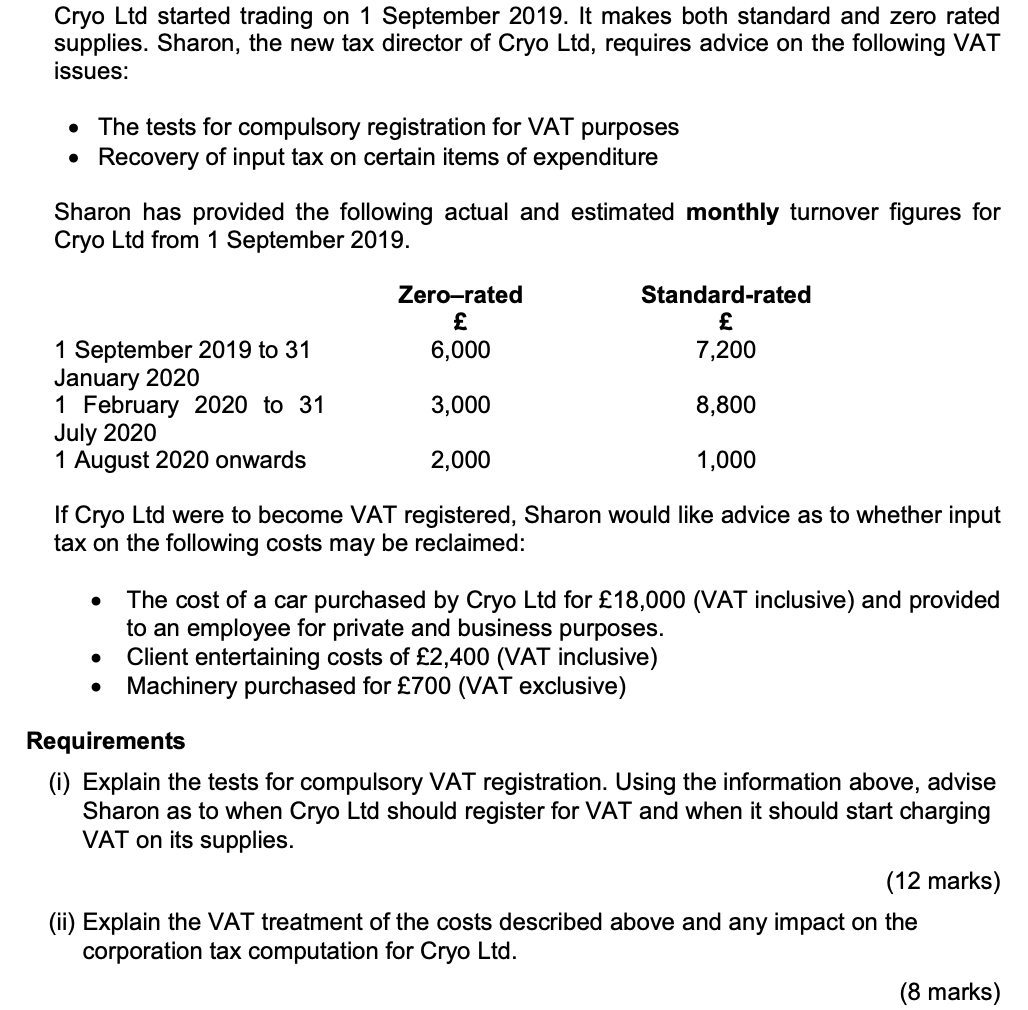

Cryo Ltd started trading on 1 September 2019. It makes both standard and zero rated supplies. Sharon, the new tax director of Cryo Ltd, requires advice on the following VAT issues: The tests for compulsory registration for VAT purposes Recovery of input tax on certain items of expenditure . Sharon has provided the following actual and estimated monthly turnover figures for Cryo Ltd from 1 September 2019. Zero-rated 6,000 Standard-rated 7,200 1 September 2019 to 31 January 2020 1 February 2020 to 31 July 2020 1 August 2020 onwards 3,000 8,800 2,000 1,000 If Cryo Ltd were to become VAT registered, Sharon would like advice as to whether input tax on the following costs may be reclaimed: The cost of a car purchased by Cryo Ltd for 18,000 (VAT inclusive) and provided to an employee for private and business purposes. Client entertaining costs of 2,400 (VAT inclusive) Machinery purchased for 700 (VAT exclusive) Requirements (i) Explain the tests for compulsory VAT registration. Using the information above, advise Sharon as to when Cryo Ltd should register for VAT and when it should start charging VAT on its supplies. (12 marks) (ii) Explain the VAT treatment of the costs described above and any impact on the corporation tax computation for Cryo Ltd. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts