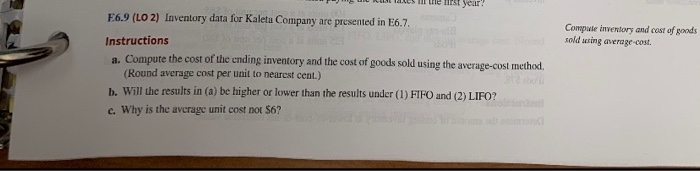

Question: CS TII trhe Iirst year? E6.9 (LO 2) Inventory data for Kaletu Company are presented in E6.7. Compute inventory and cost of goods sold using

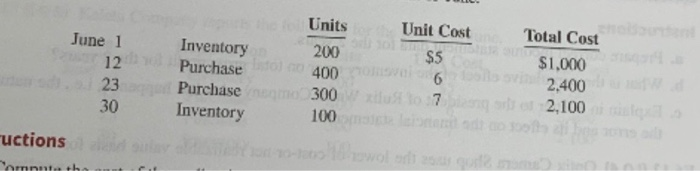

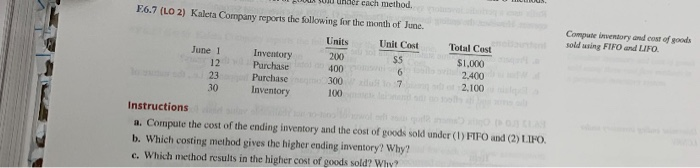

CS TII trhe Iirst year? E6.9 (LO 2) Inventory data for Kaletu Company are presented in E6.7. Compute inventory and cost of goods sold using average-cost Instructions of the ending inventory and the cost of goods sold using the average-cost method. Ewdr a. Compute the cost (Round average cost per unit to nearest cent.) b. Will the results in (a) be higher or lower than the results under (1) FIFO and (2) LIFO? c. Why is the average unit cost not $6? Ktdi Units Unit Cost Total Cost June 1 Inventory Purchase Purchase mo 300 Inventory 200 400 $5 $1,000 2,400 o2,100 12 6 23 xilu to :7 30 100 uctions hwol o qu m Tomputa the a 0unat cach method. o c E6.7 (LO 2) Kaleta Company reports the following for the month of June. Compute invenaory and cost of goods sold asing FIF0 and LIFO ntent Units Unit Cost Total Cost June 1 Inventory 12 Purchase 400 23 Purchase Inventory 200 $5 $1,000 2,400 2,100 6 iu lo 7 m300 100 30 Instructions a. Compute the cost of the ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO. b. Which costing method gives the higher ending inventory? Why? c. Which method results in the higher cost of goods sold? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts