Question: CSM Machine Shop is considering a four year project to improve its production efficiency . Buying a new machine press for $501 , god is

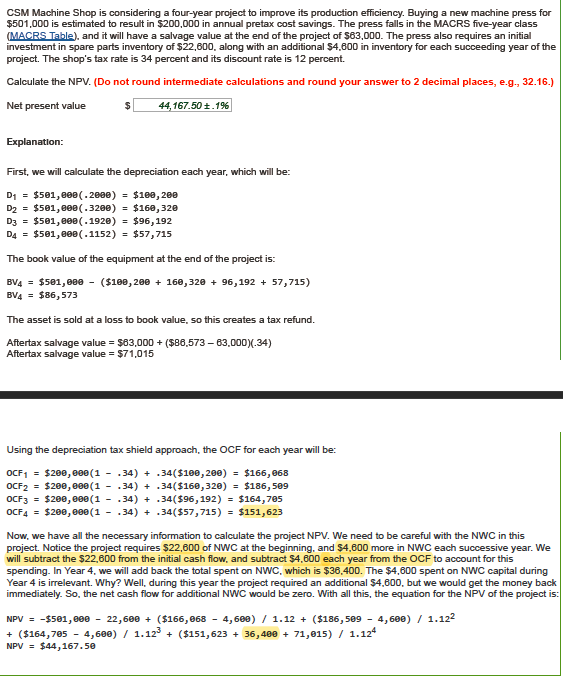

CSM Machine Shop is considering a four year project to improve its production efficiency . Buying a new machine press for $501 , god is estimated to result in $209 090 in annual pretax cost savings . The press falls in the MACKS five year class MACES Table and it will have a salvage value at the end of the project of 583 010 . The press also requires an initial investment in spare parts inventory of $22 GUO , along with an additional 54 600 in inventory for each succeeding year of the project . The shop's tax rate is 34 percent and its discount rate is 12 percent Calculate the NEY . ( Do not round intermediate calculations and round your answer to 2 decimal places , e q . , 32 16 . ) Net present value $4 16750 + 196 Explanation First , we will calculate the depreciation each year , which will be Of = $581 908 ( . 2809 ) = $160 , 28 8 $581 , BOB ( 3289 ) = $168 , 328 $581 , BBB ( 1920 ) = $96 , 192 DA = $581 9BE ( 1152 ) = $57 715 The book value of the equipment at the end of the project is BYA = $581 , BBB - ( $1BE , 268 + 168 328 + 96 , 192 + 57 , 715 ) EVA = $86 , 573 The asset is sold at a loss to book value . so this creates a tax refund Aftertax Salvage Value - 983 090 + ($69 573 - 93 0901 34 Aftertax Salvage Value - 371 015 Using the depreciation tax shield approach the OOF for each year will be $208 , 608 ( 1 34) + 341 5168 269 ) = $165 , BOB $208 909 ( 1 34) + 34 ( $168 320 ) = $186 , 589 OCF3 = $208 8Be ( 1 34 ) + 34 ($96 , 192 ) 154 . TO OCFA = $208 808 ( 1 34 ) + 34 ( $57 715 ) $151 623 Now . we have all the necessary information to calculate the project NOV . We need to be careful with the NIC in this project No tice the project requires $22 60 of NWO at the beginning , and 34 680 more in NYC each successive year . We will subtract the $27 6DO from the initial cash flow , and subtract $4 , GOD each year from the OOF to account for this pending . In Year 4 we will add back the total spent on NWO , which is far 400 . The $4 609 spent on MWC capital during Year 4 is irrelevant . Why ? Well during this year the project required an additional S4 Gun , but we would get the money back immediately . So the net cash flow for additional NWO would be zero With all this , the equation for the MPV of the project is $501 90 22 686 + ( $156 , BEB - 4 608 ) / 1 . 12 + ( $186 509 - 4 680 ) / 1 . 12 2 + ( $164 , 78 4 68 8 ) / 1 . 12 3 ($151 623 + 36 , 468 + 71 915 ) / 1. 12 $44 167 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts