Question: ctice #6 i Saved Help Save & Exit Check You have just learned that you are a beneficiary in the will of your late Aunt

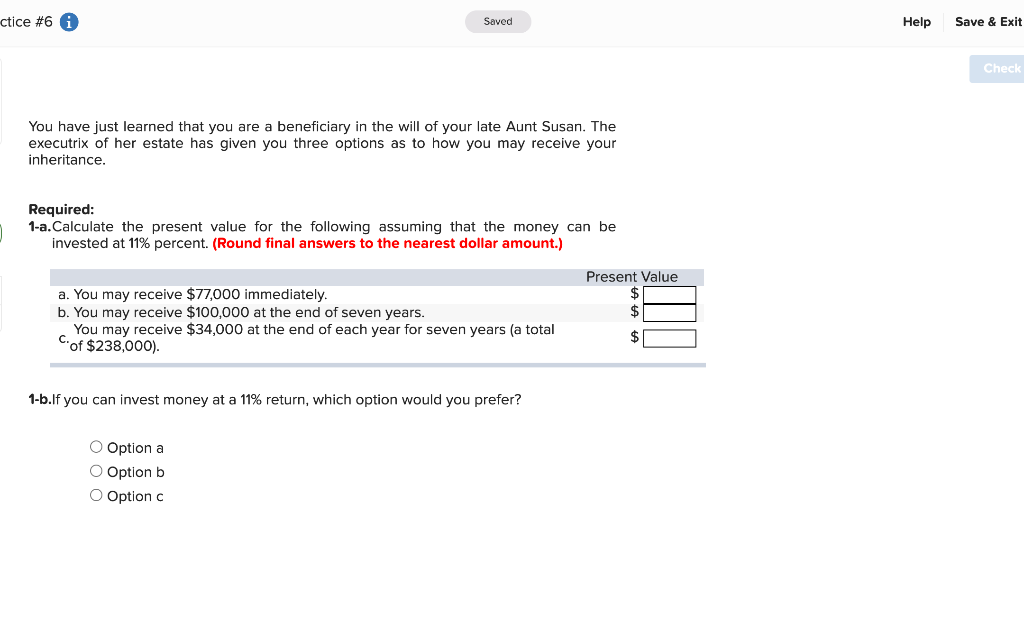

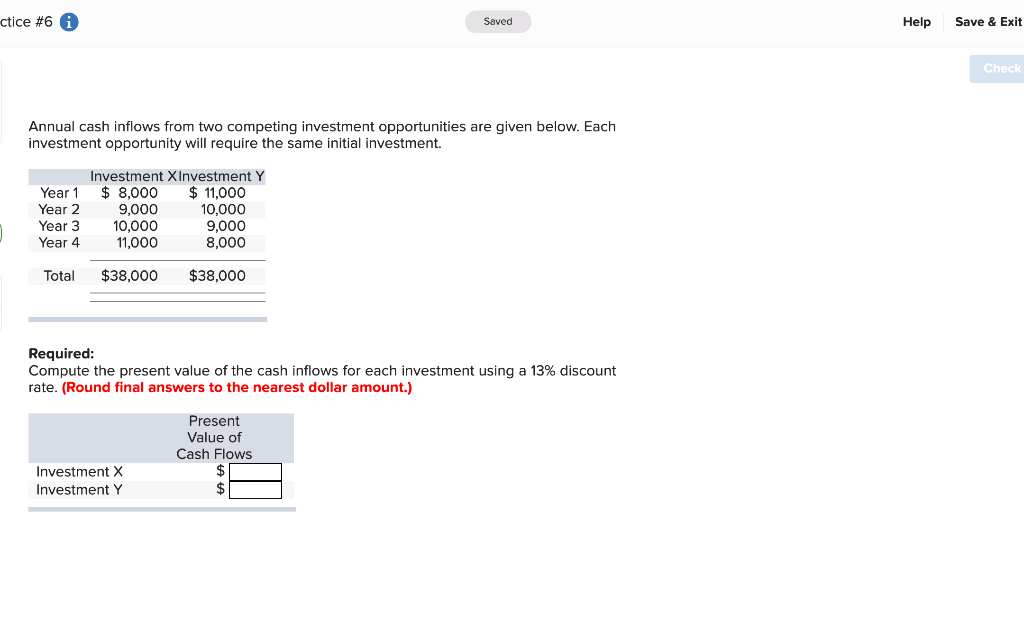

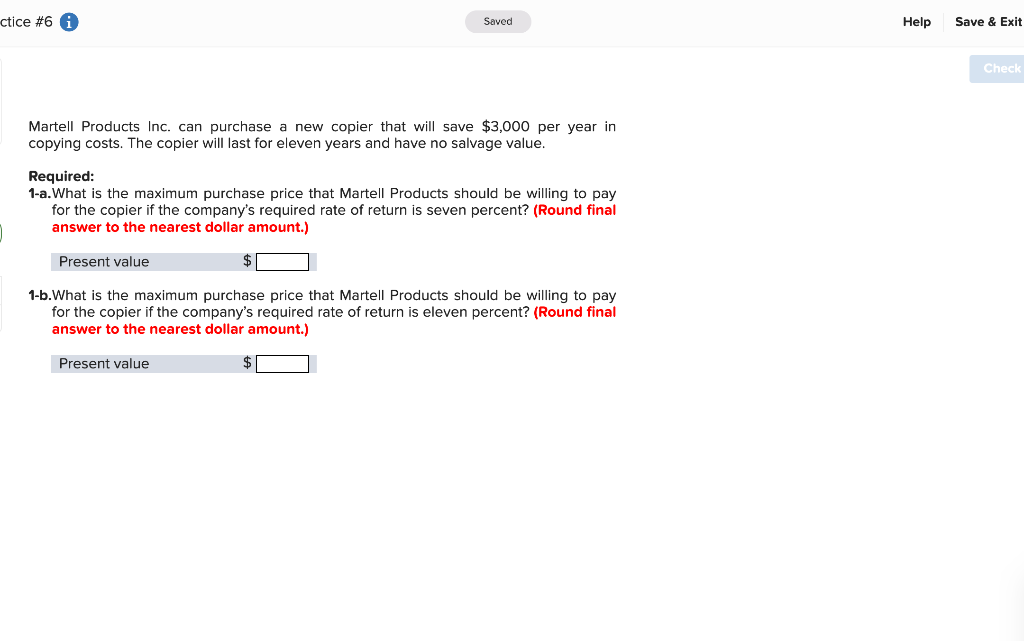

ctice #6 i Saved Help Save & Exit Check You have just learned that you are a beneficiary in the will of your late Aunt Susan. The executrix of her estate has given you three options as to how you may receive your inheritance. Required: 1-a.Calculate the present value for the following assuming that the money can be invested at 11% percent. (Round final answers to the nearest dollar amount.) Present Value a. You may receive $77,000 immediately. b. You may receive $100,000 at the end of seven years. You may receive $34,000 at the end of each year for seven years (a total Cof $238,000). $ 1-b.If you can invest money at a 11% return, which option would you prefer? Option a O Option b O Optionc ctice #6 A Saved Help Save & Exit Check Annual cash inflows from two competing investment opportunities are given below. Each investment opportunity will require the same initial investment Year 1 Year 2 Year 3 Year 4 Investment XInvestment Y $ 8,000 $ 11,000 9,000 10,000 10,000 11,000 8,000 9,000 Total $38,000 $38,000 Required: Compute the present value of the cash inflows for each investment using a 13% discount rate. (Round final answers to the nearest dollar amount.) Present Value of Cash Flows Investment X Investment Y ctice #6 A Saved Help Save & Exit Check Martell Products Inc. can purchase a new copier that will save $3,000 per year in copying costs. The copier will last for eleven years and have no salvage value. Required: 1-a.What is the maximum purchase price that Martell Products should be willing to pay for the copier if the company's required rate of return is seven percent? (Round final answer to the nearest dollar amount.) Present value 1-b.What is the maximum purchase price that Martell Products should be willing to pay for the copier if the company's required rate of return is eleven percent? (Round final answer to the nearest dollar amount.) Present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts