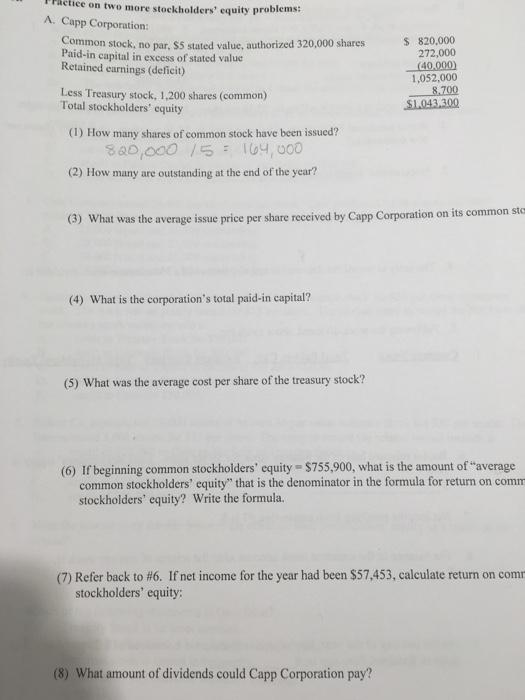

Question: ctice on two more stockholders' equity problems: A. Capp Corporation: Common stock, no par, $5 stated value, authorized 320,000 shares Paid-in capital in excess

ctice on two more stockholders' equity problems: A. Capp Corporation: Common stock, no par, $5 stated value, authorized 320,000 shares Paid-in capital in excess of stated value Retained earnings (deficit) $ 820,000 272,000 (40,000) 1,052,000 Less Treasury stock, 1,200 shares (common) Total stockholders' equity 8.700 $1,043,300 (1) How many shares of common stock have been issued? 820,000 15 = 164,000 (2) How many are outstanding at the end of the year? (3) What was the average issue price per share received by Capp Corporation on its common stom (4) What is the corporation's total paid-in capital? (5) What was the average cost per share of the treasury stock? (6) If beginning common stockholders' equity $755,900, what is the amount of "average common stockholders' equity" that is the denominator in the formula for return on comm stockholders' equity? Write the formula. (7) Refer back to #6. If net income for the year had been $57,453, calculate return on comm stockholders' equity: (8) What amount of dividends could Capp Corporation pay?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts