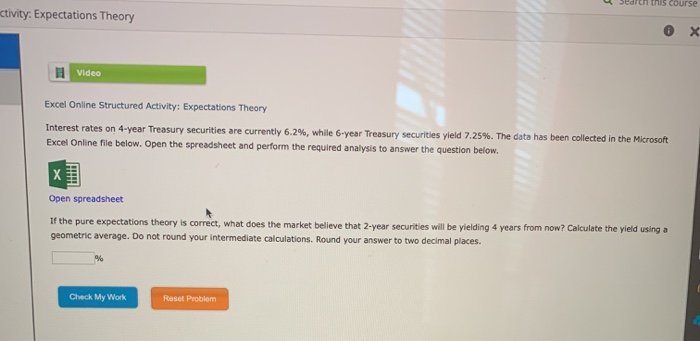

Question: ctivity: Expectations Theory X Video Excel Online Structured Activity: Expectations Theory Interest rates on 4-year Treasury securities are currently 6.2%, while 6-year Treasury securities yield

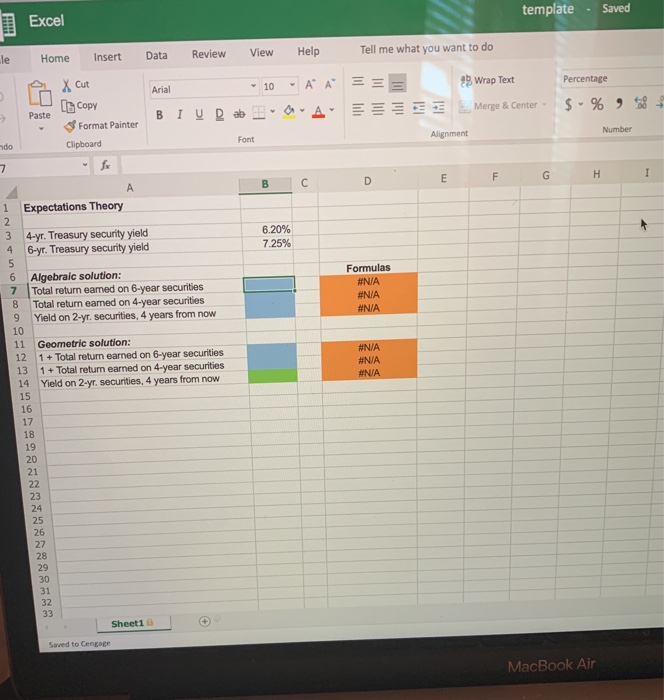

ctivity: Expectations Theory X Video Excel Online Structured Activity: Expectations Theory Interest rates on 4-year Treasury securities are currently 6.2%, while 6-year Treasury securities yield 7.25%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If the pure expectations theory is correct, what does the market believe that 2-year securities will be yielding 4 years from now? Calculate the yield using a geometric average. Do not round your intermediate calculations. Round your answer to two decimal places. Check My Work Reset Problem Excel template - Saved le Home Insert Data Review View Help Tell me what you want to do X Cut Arial 29 Wrap Text Percentage Copy - 10 -A A BI U DabCA E Paste Merge & Center $ - % Format Painter Clipboard Font Alignment Number . E F G H I 1 Expectations Theory 4-yr. Treasury security yield 6-yr. Treasury security yield 6.20% 7.25% Formulas 6 7 8 9 Algebraic solution: Total return eamed on 6-year securities Total return eamed on 4-year securities Yield on 2-yr. securities, 4 years from now NA #N/A #N/A 11 Geometric solution: 12 1 + Total return earned on 6-year securities 13 1 + Total return earned on 4-year securities 14 Yield on 2-yr. securities, 4 years from now #N/A ANA INA Sheet1 Saved to engage MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts