Question: CTRL + command TO SEE CLEARLY DROPDOWN OPTIONS: 1ST: greater than / lower than / equal to 2ND: selling price is too low/ selling price

CTRL + command TO SEE CLEARLY

DROPDOWN OPTIONS:

1ST: greater than / lower than / equal to

2ND: selling price is too low/ selling price is too high / stock is correctly priced

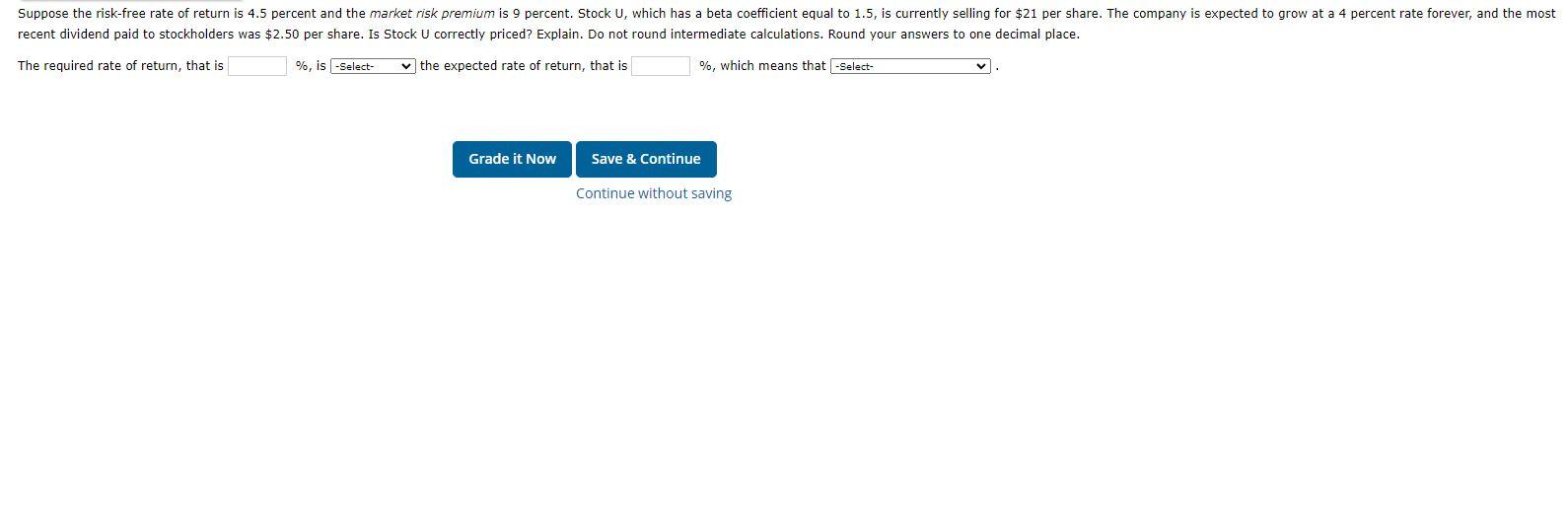

Suppose the risk-free rate of return is 4.5 percent and the market risk premium is 9 percent. Stock U, which has a beta coefficient equal to 1.5, is currently selling for $21 per share. The company is expected to grow at a 4 percent rate forever, and the most recent dividend paid to stockholders was $2.50 per share. Is Stock U correctly priced? Explain. Do not round intermediate calculations. Round your answers to one decimal place. The required rate of return, that is %, is -Select- v the expected rate of return, that is %, which means that -Select- Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts