Question: CTRL + to see clearly DROP DOWN OPTIONS 1) yeso 2) yeso 3) thus, only project S/ only project L / both projects / neither

CTRL + to see clearly

DROP DOWN OPTIONS

1) yeso

2) yeso

3) thus, only project S/ only project L / both projects / neither projects

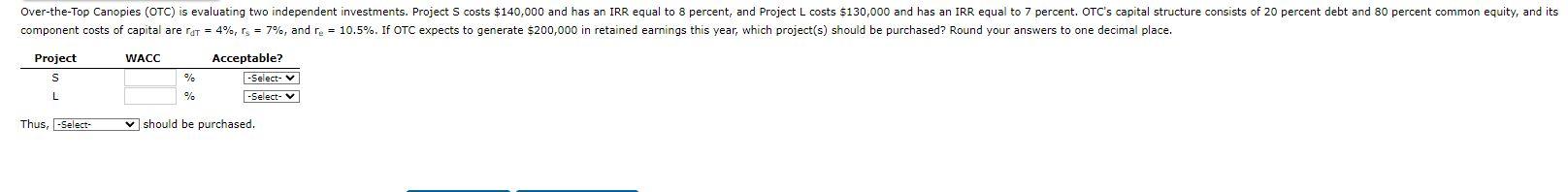

Over-the-Top Canopies (OTC) is evaluating two independent investments. Project S costs $140,000 and has an IRR equal to 8 percent, and Project L costs $130,000 and has an IRR equal to 7 percent. OTC's capital structure consists of 20 percent debt and 80 percent common equity, and its component costs of capital are rat = 4%, rs = 7%, and re = 10.5%. If OTC expects to generate $200,000 in retained earnings this year, which project(s) should be purchased? Round your answers to one decimal place. Project WACC Acceptable? -Select- % L % -Select- Thus, -Select- should be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts