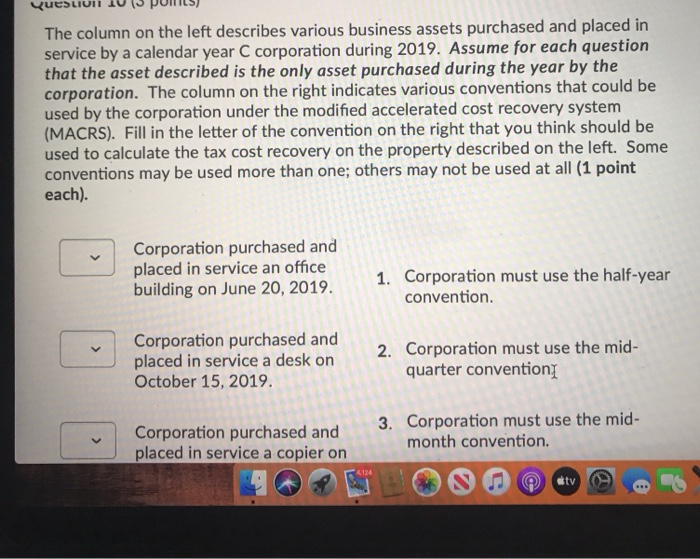

Question: CUCULUM 10 UPONL) The column on the left describes various business assets purchased and placed in service by a calendar year C corporation during 2019.

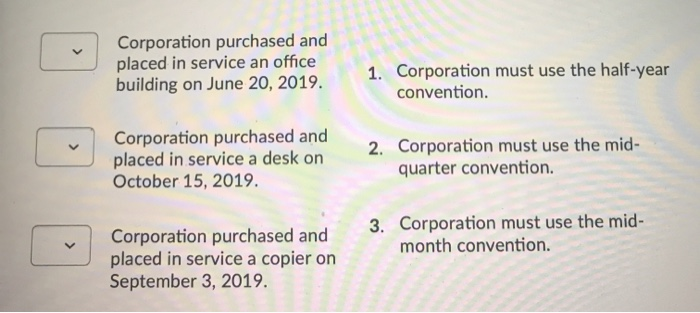

CUCULUM 10 UPONL) The column on the left describes various business assets purchased and placed in service by a calendar year C corporation during 2019. Assume for each question that the asset described is the only asset purchased during the year by the corporation. The column on the right indicates various conventions that could be used by the corporation under the modified accelerated cost recovery system (MACRS). Fill in the letter of the convention on the right that you think should be used to calculate the tax cost recovery on the property described on the left. Some conventions may be used more than one; others may not be used at all (1 point each) Corporation purchased and placed in service an office building on June 20, 2019. Corporation must use the half-year convention. Corporation purchased and placed in service a desk on October 15, 2019. 2. Corporation must use the mid- quarter convention Corporation purchased and placed in service a copier on 3. Corporation must use the mid- month convention. Corporation purchased and placed in service an office building on June 20, 2019. 1. Corporation must use the half-year convention Corporation purchased and placed in service a desk on October 15, 2019. 2. Corporation must use the mid- quarter convention. Corporation purchased and placed in service a copier on September 3, 2019. 3. Corporation must use the mid- month convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts