Question: Cuda Marine Engines, Inc. must develop the cash flow estimates for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs

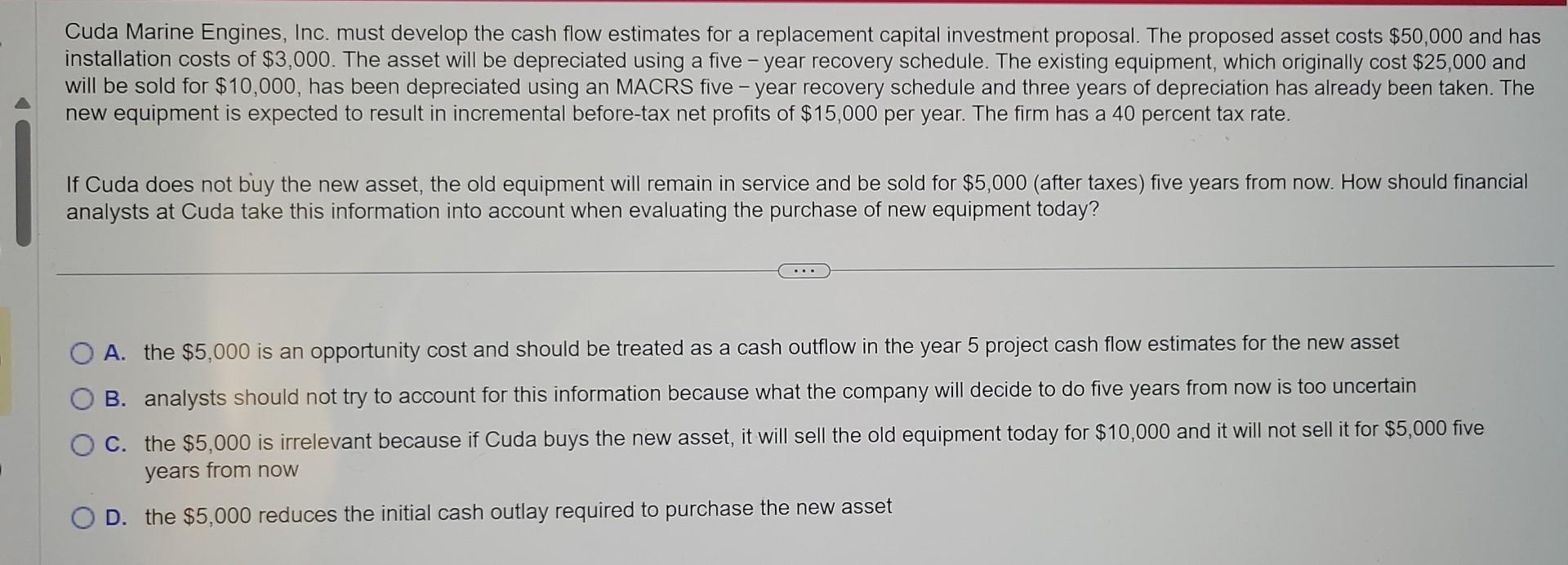

Cuda Marine Engines, Inc. must develop the cash flow estimates for a replacement capital investment proposal. The proposed asset costs $50,000 and has installation costs of $3,000. The asset will be depreciated using a five - year recovery schedule. The existing equipment, which originally cost $25,000 and will be sold for $10,000, has been depreciated using an MACRS five-year recovery schedule and three years of depreciation has already been taken. The new equipment is expected to result in incremental before-tax net profits of $15,000 per year. The firm has a 40 percent tax rate. If Cuda does not buy the new asset, the old equipment will remain in service and be sold for $5,000 (after taxes) five years from now. How should financial analysts at Cuda take this information into account when evaluating the purchase of new equipment today? A. the $5,000 is an opportunity cost and should be treated as a cash outflow in the year 5 project cash flow estimates for the new asset B. analysts should not try to account for this information because what the company will decide to do five years from now is too uncertain C. the $5,000 is irrelevant because if Cuda buys the new asset, it will sell the old equipment today for $10,000 and it will not sell it for $5,000 five years from now D. the $5,000 reduces the initial cash outlay required to purchase the new asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts