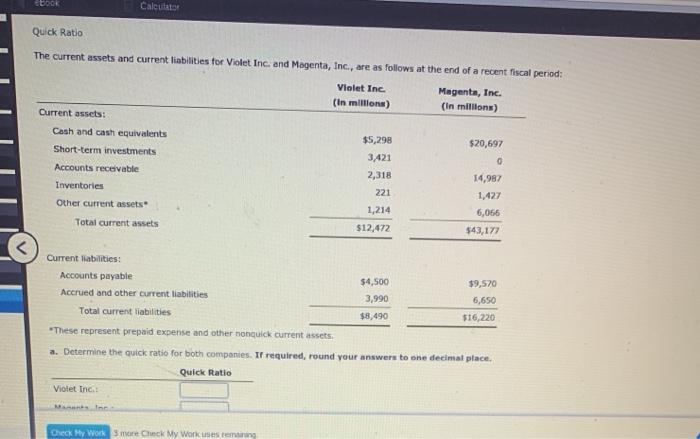

Question: CUDO Calculator Quick Ratio The current assets and current liabilities for Violet Inc. and Magenta, Inc., are as follows at the end of a recent

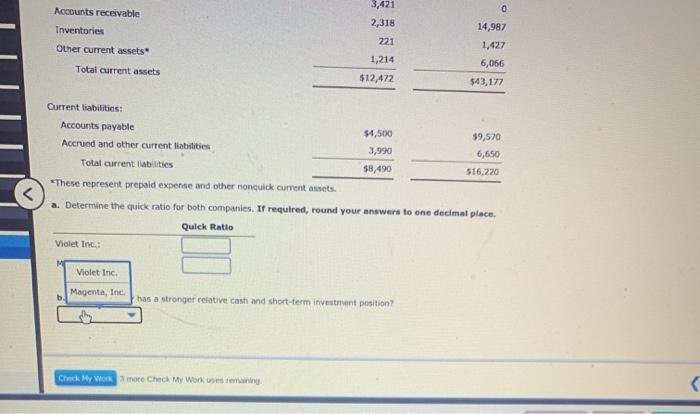

CUDO Calculator Quick Ratio The current assets and current liabilities for Violet Inc. and Magenta, Inc., are as follows at the end of a recent fiscal period: Violet Inc. Magenta, Inc. (in millions) (in millions) Current assets: Cash and cash equivalents $5,298 $20,697 Short-term investments 3,421 Accounts receivable 2,318 14,987 Inventories 221 1,427 Other current assets 1,214 6,066 Total current assets $12,472 $43, 177 Current liabilities: Accounts payable Accrued and other current liabilities Total current liabilities $4,500 3,990 $8,490 $9,570 6,650 $16,220 *These represent prepaid expense and other nonquick current assets a. Determine the quick ratio for both companies. If required, round your answers to one decimal place. Quick Ratio Violet Inc Me Check My Work more Check My Work uses Accounts receivable Inventories Other current assets 3,421 2,318 221 1,214 $12,472 14,987 1,427 6,066 $43,177 Total current assets Current liabilities: Accounts payable $4,500 59,570 Accrued and other current liabilities 3,990 6,650 Total current liabilities $8,490 516,220 *These represent prepaid expense and other nonquick current assets. a. Determine the quick ratio for both companies. If required, round your answers to one decimal place. Quick Ratio Violet Inc.: Violet Inc Magenta, Inc b has a stronger relative cash and short-term investment position? Check Wonote Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts