Question: Cuestion 4 10 marks) Attraction Ltd. is currently evaluating its options for raising financing for a new project. Its stock currently salls for $27

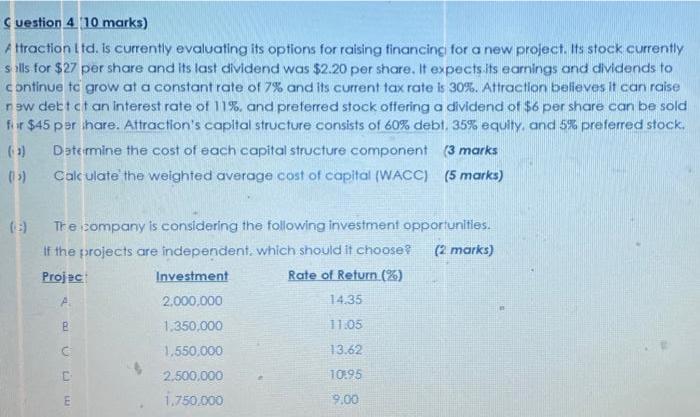

Cuestion 4 10 marks) Attraction Ltd. is currently evaluating its options for raising financing for a new project. Its stock currently salls for $27 per share and its last dividend was $2.20 per share. It expects its earnings and dividends to continue to grow at a constant rate of 7% and its current tax rate is 30%. Attraction believes it can raise new debt ct an interest rate of 11%, and preferred stock offering a dividend of $6 per share can be sold for $45 per hare. Attraction's capital structure consists of 60% debt, 35% equity, and 5% preferred stock. (1) (>) (8) Determine the cost of each capital structure component (3 marks Calculate the weighted average cost of capital (WACC) (5 marks) The company is considering the following investment opportunities. If the projects are independent, which should it choose? (2 marks) Projec Investment Rate of Return (%) 2,000,000 14.35 1,350,000 11:05 1,550,000 13.62 2.500,000 10.95 1,750,000 9.00 T no G C

Step by Step Solution

There are 3 Steps involved in it

Answer A Cost of each component 1 Cost of equity Formula dividend per share next yearmarket pri... View full answer

Get step-by-step solutions from verified subject matter experts