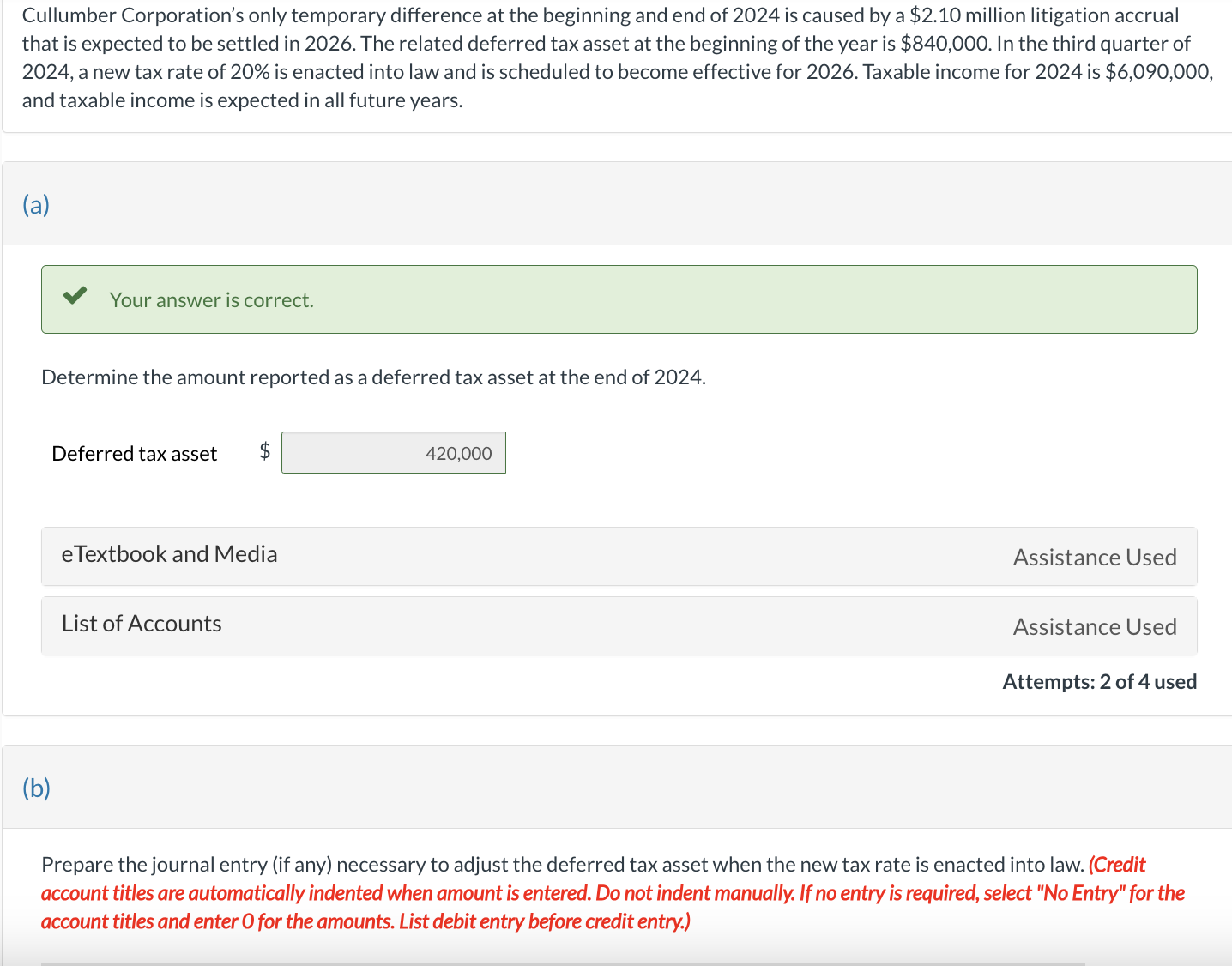

Question: Cullumber Corporation's only temporary difference at the beginning and end of 2 0 2 4 is caused by a $ 2 . 1 0 million

Cullumber Corporation's only temporary difference at the beginning and end of is caused by a $ million litigation accrual

that is expected to be settled in The related deferred tax asset at the beginning of the year is $ In the third quarter of

a new tax rate of is enacted into law and is scheduled to become effective for Taxable income for is $

and taxable income is expected in all future years.

a

Your answer is correct.

Determine the amount reported as a deferred tax asset at the end of

Deferred tax asset $

eTextbook and Media

List of Accounts

Assistance Used

Assistance Used

Attempts: of used

b

Prepare the journal entry if any necessary to adjust the deferred tax asset when the new tax rate is enacted into law. Credit

account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the

account titles and enter for the amounts. List debit entry before credit entry.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock