Question: Cullumber has an aggressive growth plan, which will require significant investments in plant and equipment over the next several years. Preliminary plans call for an

Cullumber has an aggressive growth plan, which will require significant investments in plant and equipment over the next several years. Preliminary plans call for an investment of over $500,000 in the next year. Compute Cullumbers free cash flow.

| Free cash flow ? |

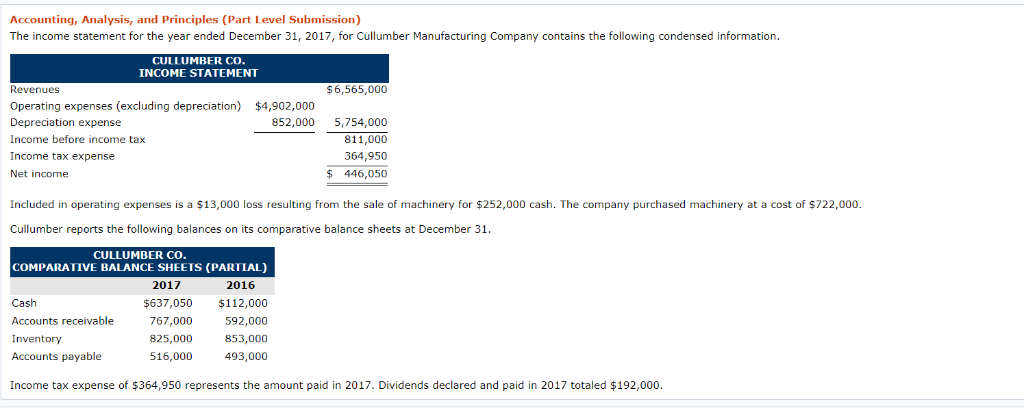

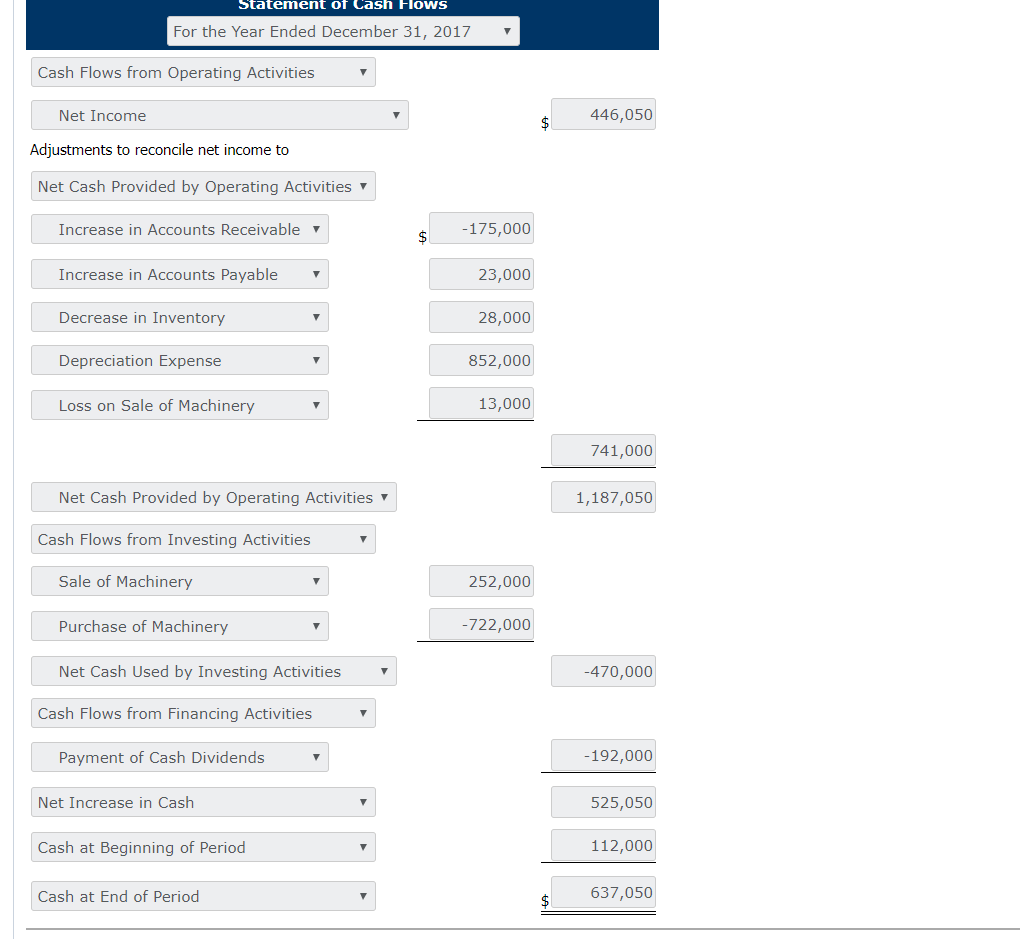

Accounting, Analysis, and Principles (Part Level Submission) The income statement for the year ended December 31, 2017, for Cullumber Manufacturing Company contains the following condensed information CULLUMBER CO INCOME STATEMENT $6,565,000 Revenues Operating expenses (excluding depreciation) Depreciation expense Income before income tax Income tax expense Net income $4,902,000 852,000 5,754,000 811,000 364,950 $ 446,050 Included in operating expenses is a $13,000 loss resulting from the sale of machinery for $252,000 cash. The company purchased machinery at a cost of $722,000 Cullumber reports the following balances on its comparative balance sheets at December 31 CULLUMBER CO COMPARATIVE BALANCE SHEETS (PARTIAL) 2017 2016 Cash Accounts receivable Inventory Accounts payable $637,050 $112,000 592,000 853,000 493,000 767,000 825,000 516,000 Income tax expense of $364,950 represents the amount paid in 2017. Dividends declared and paid in 2017 totaled $192,000 Statement of Cash FloNS For the Year Ended December 31, 2017 Cash Flows from Operating Activities Net Income 446,050 Adjustments to reconcile net income to Net Cash Provided by Operating Activities s175,000 23,000 28,000 852,000 13,000 Increase in Accounts Receivable Increase in Accounts Payable Decrease in Inventory Depreciation Expense Loss on Sale of Machinery 741,000 Net Cash Provided by Operating Activities 1,187,050 Cash Flows from Investing Activities Sale of Machinery Purchase of Machinery Net Cash Used by Investing Activities 252,000 -722,000 -470,000 Cash Flows from Financing Activities 192,000 525,050 112,000 637,050 Payment of Cash Dividends Net Increase in Cash Cash at Beginning of Period Cash at End of Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts