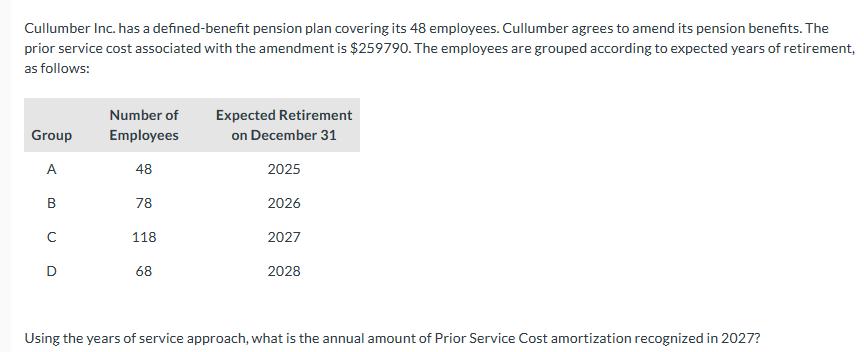

Question: Cullumber Inc. has a defined-benefit pension plan covering its 48 employees. Cullumber agrees to amend its pension benefits. The prior service cost associated with

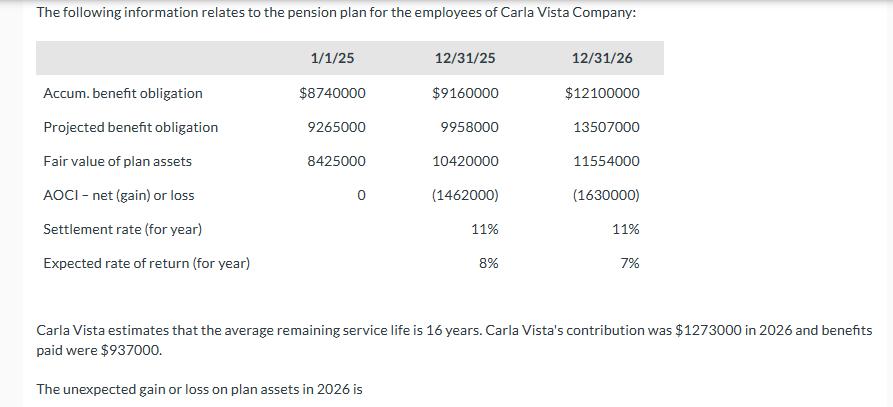

Cullumber Inc. has a defined-benefit pension plan covering its 48 employees. Cullumber agrees to amend its pension benefits. The prior service cost associated with the amendment is $259790. The employees are grouped according to expected years of retirement, as follows: Group Number of Employees Expected Retirement on December 31 A 48 2025 B 78 2026 118 2027 D 68 2028 Using the years of service approach, what is the annual amount of Prior Service Cost amortization recognized in 2027? The following information relates to the pension plan for the employees of Carla Vista Company: 1/1/25 12/31/25 12/31/26 Accum. benefit obligation $8740000 $9160000 $12100000 Projected benefit obligation 9265000 9958000 13507000 Fair value of plan assets 8425000 10420000 11554000 AOCI - net (gain) or loss 0 (1462000) (1630000) Settlement rate (for year) 11% 11% Expected rate of return (for year) 8% 7% Carla Vista estimates that the average remaining service life is 16 years. Carla Vista's contribution was $1273000 in 2026 and benefits paid were $937000. The unexpected gain or loss on plan assets in 2026 is

Step by Step Solution

There are 3 Steps involved in it

To calculate the annual amount of Prior Service Cost using the years of service approac... View full answer

Get step-by-step solutions from verified subject matter experts