Question: CullumberInc. leased a new crane to Bramble Construction under a 5-year, non-cancelable contract starting January 1, 2020. Terms of the lease require payments of $46,500

CullumberInc. leased a new crane to Bramble Construction under a 5-year, non-cancelable contract starting January 1, 2020. Terms of the lease require payments of $46,500 each January 1, starting January 1, 2020. The crane has an estimated life of 7 years, a fair value of $230,000, and a cost to Cullumber of $230,000. The estimated fair value of the crane is expected to be $40,000 (unguaranteed) at the end of the lease term. No bargain purchase or renewal options are included in the contract, and it is not a specialized asset. Both Cullumber and Bramble adjust and close books annually at December 31. Collectibility of the lease payments is probable. Brambles incremental borrowing rate is 10%, and Cullumbers implicit interest rate of 10% is known to Bramble.

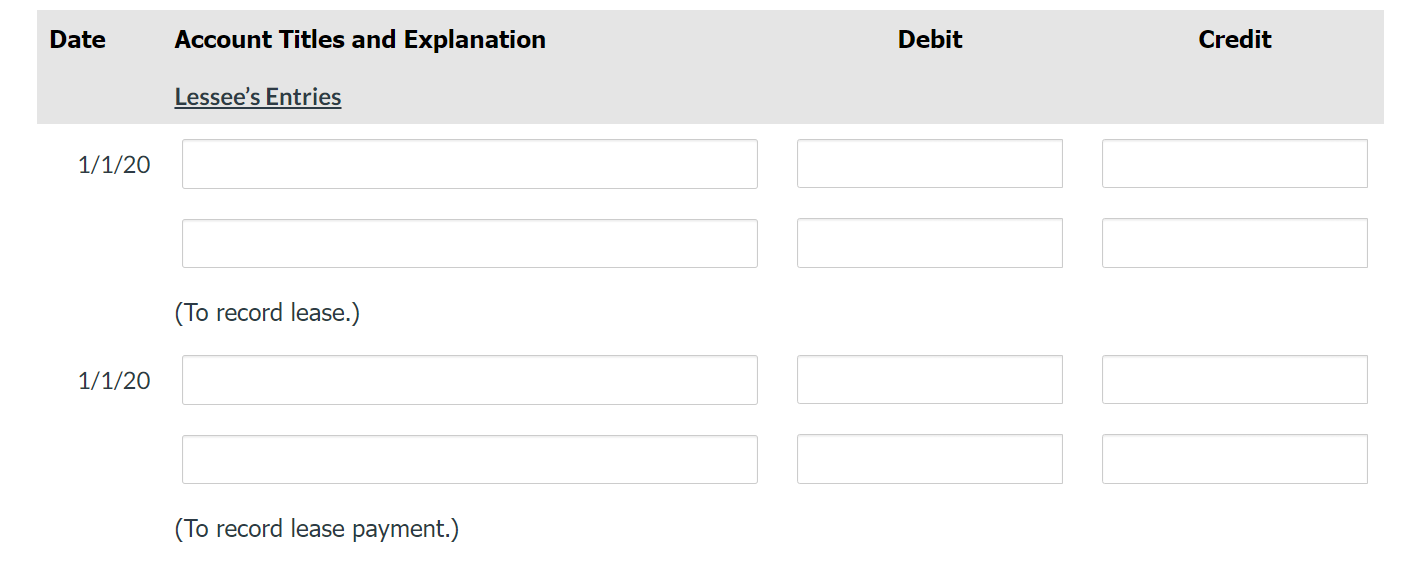

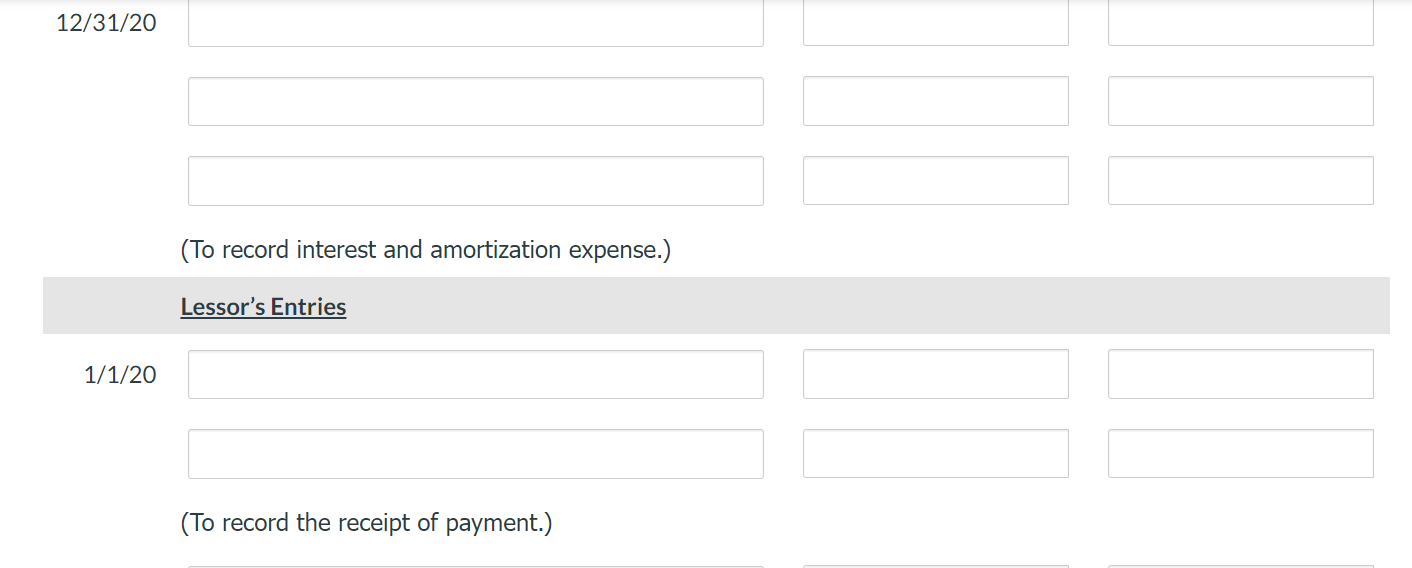

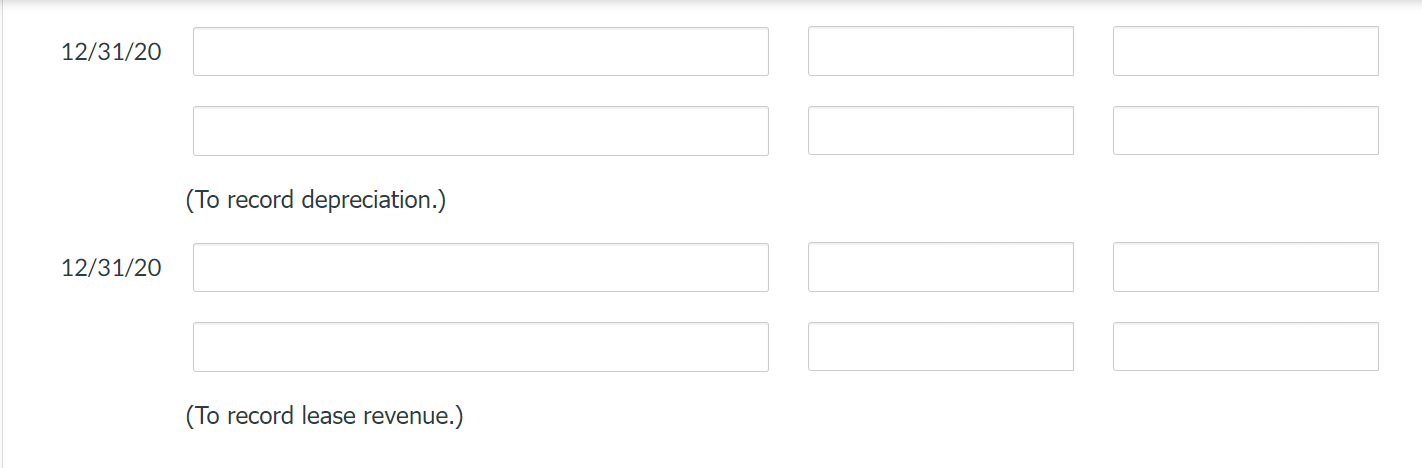

Prepare all the entries related to the lease contract and leased asset for the year 2020 for the lessee and lessor, assuming Bramble uses straight-line amortization for all similar leased assets, and Cullumber depreciates the asset on a straight-line basis with a salvage value of $15,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25125 and the final answer to 0 decimal places e.g. 58,972.)

Date Account Titles and Explanation Debit Credit Lessee's Entries 1/1/20 (To record lease.) 1/1/20 (To record lease payment.) 12/31/20 (To record interest and amortization expense.) Lessor's Entries 1/1/20 (To record the receipt of payment.) 12/31/20 (To record depreciation.) 12/31/20 (To record lease revenue.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts