Question: cument's format. Some content might be missing or displayed improperly. 1 . 2 .3 . 4 .5. 7 1. If you wish to have $20,000

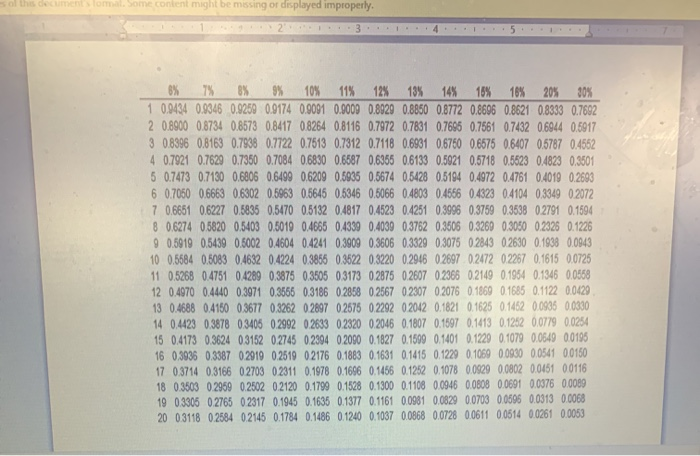

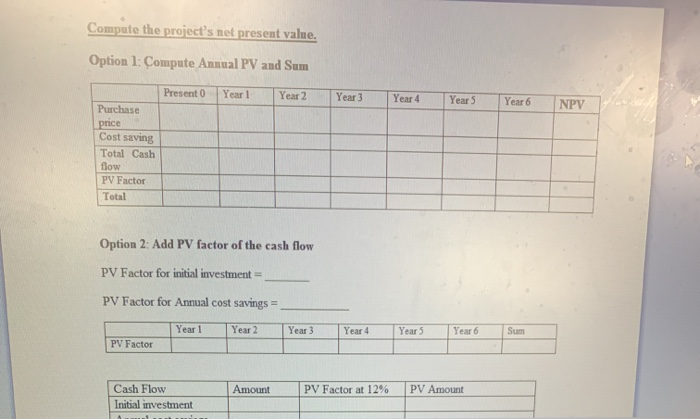

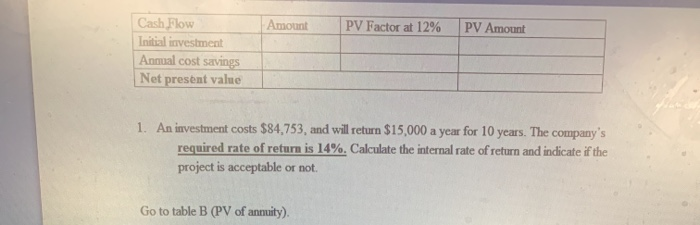

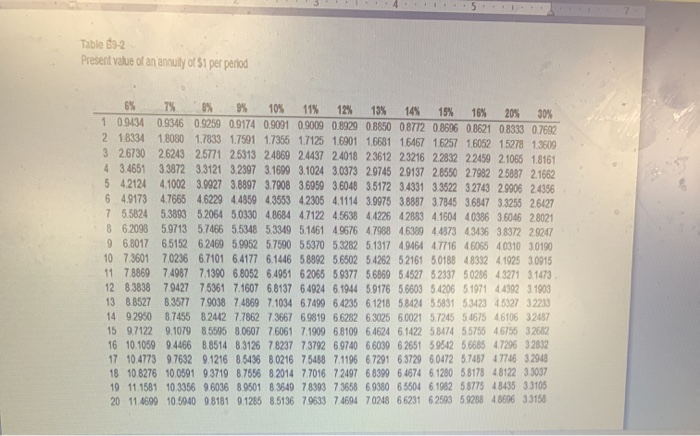

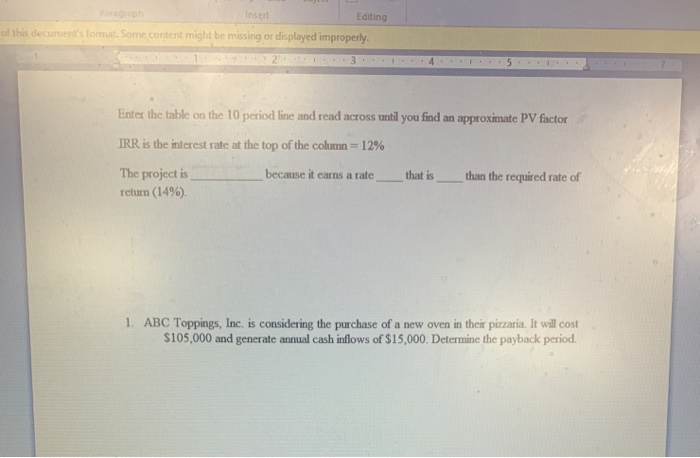

cument's format. Some content might be missing or displayed improperly. 1 . 2 .3 . 4 .5. 7 1. If you wish to have $20,000 at the end of eight years, what amount must you invest today if your investment earns an annual interest rate of 12 percent each year? 1. Ramsey Co. is interested in acquiring a new machine that costs $92,000. The machine will last 6 years and provide a cost savings of $23,000 a year. The required rate of return is 12% sol this documentlommal. Some content might be missing or displayed improperly. 8% 7% 8% 9% 10% 11% 12% 13% 14% 18% 18% 20% 30% 1 0.9434 0.9346 0.9259 0.9174 0.9091 0.0009 0.8929 0.8850 0.8772 0.8696 0.8621 0.8333 0.7692 20.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.7561 0.7432 0.6944 0.5917 3 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6760 0.6575 0.6407 0.5787 0.4552 4 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.5718 0.5623 0.4823 0.5501 5 0.7473 0.7130 0.6806 0.6499 0.6209 0.5035 0.5674 0.5428 0.5194 0.4972 0.4761 0.4019 0.2693 6 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0,5066 0.4803 0.4556 0.4323 0.4104 0.3349 02072 7 0.6661 0.6227 0.5835 0.5470 05132 0.4817 0.4523 0.4251 0.3996 0.3759 0.3538 0.2791 0.1594 8 0.6274 0.5820 0.5403 0.5010 0.4665 0.4339 0.4039 0.3762 0.3506 0.3260 0.3050 0.2326 0.1226 90.5919 0.5439 0.6002 0.4604 0.4241 0.3909 0.3606 0.3329 0.3075 02843 02630 0.1938 0.0943 10 0.5684 0.5083 0.4632 0.4224 0.3856 0.3622 0.3220 0.2946 02697 0.2472 02267 0.1615 0.0725 11 0.5268 0.4751 04289 0.3875 0.3505 03173 02875 02607 02366 02149 0.1954 0.1346 0.0568 12 0.4970 0.4440 0.3971 0.3666 0.3186 02858 02567 02307 02076 0.1869 0.1685 0.1122 0.0429 13 0.4688 0.4150 0.3677 0.3262 02897 0257502292 0 2012 0.1821 0.1625 0.1452 0.0935 0.0330 14 0.4423 0.3878 03406 0.2992 0.2633 0.232002046 0.1807 0.1597 0.1413 0.1252 0.0779 0.0254 15 0.4173 0.3624 03152 02745 0.2994 02090 0.1827 0.1599 0.1401 0.1229 0.1079 0.0649 0.0195 16 0.3936 03387 02919 02519 02176 0.1883 0.1631 0.1415 0.1229 0.1069 0.0930 0.0541 0.0150 17 0.3714 0.3166 02703 02311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 0.0802 0.0451 00116 18 0.3503 02959 0.2502 0.2120 0.1799 0.1528 0.1300 0.1108 0.0946 0.0808 0.0691 0.0376 0.0089 19 03305 02765 0 2317 0.1945 0.1635 0.1377 0.1161 0.0981 0.0829 0.0703 0.0596 0.0313 0.0068 20 03118 02584 02145 0.1784 0.1486 0.1240 0.1037 0.0868 0.0728 0.0611 0.0614 0.0261 0.0053 Compute the project's net present value. Option 1: Compute Annual PV and Sum Present 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 NPV Purchase price Cost saving Total Cash flow PV Factor Total Option 2: Add PV factor of the cash flow PV Factor for initial investment = PV Factor for Annual cost savings = Year 1 Year 3 Year 4 Years Year 6 PV Factor Cash Flow Amount PV Factor at 12% PV Amount Initial investment Amount PV Factor at 12% PV Amount Cash Flow Initial investment Anmal cost savings Net present value 1. An investment costs $84,753, and will return $15,000 a year for 10 years. The company's required rate of return is 14%. Calculate the internal rate of return and indicate if the project is acceptable or not. Go to table B (PV of annuity). Table 83-2 Present value of an annully of 51 per period 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 10% 20% 30% 1 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 08772 0.8696 0.8621 08333 0.7692 2 18334 1.8080 1.7833 1.7591 17355 1.7125 1.6901 1.6681 16467 1.6257 1.6052 15278 13609 3 2.6730 2.6243 2.5771 25313 2.4869 2.4437 24018 2.3612 23216 2.2832 22459 2.1065 1.8161 4 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 2.9745 29137 28550 27982 2.5887 2.1662 5 42124 41002 3.9927 3.8897 3.7908 3.6959 3.6048 3.5172 3.4331 3.3522 32743 2.9906 2.4356 6 4.91734.7665 4.6229 4.4859 4.3553 42306 4.1114 3.9975 3.8887 3.7845 3.6847 3.3255 26427 7 5.5824 5.3893 52064 5.0330 4.8684 4.7122 45638 4.4226 42883 4.1604 40386 3.6046 28021 8 62098 5.9713 57466 55348 53349 5.1461 4.967647988 46389 44373 43436 3.8372 29247 9 6.8017 65152 62469 5.9952 57590 55370 5.3282 5.1317 49464 4771646065 40310 3.0190 10 7.360170236 6.7101 6.4177 6.1446 58892 5.6502 5.4262 52161 5.0188 483324 1925 3.0915 11 7.886974987 7.1390 6.8052 6.4951 62065 5.9377 5.6869 5.4527 52337 50286 43271 31473 12 8.383879427 75361 7.1607 6.8137 6.4924 6.1944 5.9176 5.6603 5.4206 5.1971 44392 3.1903 13 8.8527 6.3577 7.9038 7.4869 7.1034 67499 6.4235 6.1218 58424 5.5831 53423 45327 32233 14 92950 8.74558.2442 7.7862 7.3667 6.9819 6.6282 6.3025 6.0021 5.7245 54675 4,6106 32487 159.7122 9.107985595 8.0607 7.6061 7.1909 6.8109 6.4624 6.1422 58474 5575546755 32682 16 10.1059 9.4466 8.8514 8.3126 7.8237 73792 6.9740 66039 6 2651 5.9542 5.6685 47296 32832 17 10.4773 9.7632 9.1216 85436 8.0216 75488 7. 1196 67291 63729 6,04725.748747746 32948 18108276 10.0591 93719 8.7656 8 2014 7.7016 72497 68399 6.4674 6.1280 58178 48122 3,3037 19 11.1581 10 3356 96036 8.9501 836497839373658 69380 65504 6.1982 58775 48435 33105 20 11 4699 10.5040 98181 9.1266 8.5136 7.9633 7469470248 66231 62583 59288 48696 33158 Insert Editing of this decument's formal. Some content might be missing or displayed improperly. Enter the table on the 10 period line and read across until you find an approximate PV factor IRR is the interest rate at the top of the column= 12% because it earns a rate The project is return (14%). that is than the required rate of 1. ABC Toppings, Inc. is considering the purchase of a new oven in their pizzaria. It will cost $105,000 and generate annual cash inflows of $15,000. Determine the payback period. 1. Brown Company is considering the purchase of new equipment that will cost $200,000 and last 6 years. It is expected that net income will increase by $15,000 a year. Determine the accounting rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts