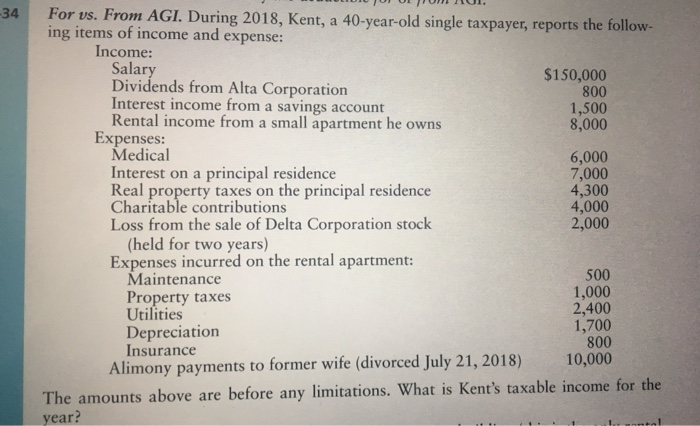

Question: CUOLUMNIU. -34 For vs. From AGI. During 2018, Kent, a 40-year-old single taxpayer, reports the follow- ing items of income and expense: Income: Salary $150,000

CUOLUMNIU. -34 For vs. From AGI. During 2018, Kent, a 40-year-old single taxpayer, reports the follow- ing items of income and expense: Income: Salary $150,000 Dividends from Alta Corporation 800 Interest income from a savings account 1,500 Rental income from a small apartment he owns 8,000 Expenses: Medical 6,000 Interest on a principal residence 7,000 Real property taxes on the principal residence 4,300 Charitable contributions 4,000 Loss from the sale of Delta Corporation stock 2,000 (held for two years) Expenses incurred on the rental apartment: Maintenance 500 Property taxes 1,000 Utilities 2,400 1,700 Depreciation 800 Insurance 10,000 Alimony payments to former wife (divorced July 21, 2018) The amounts above are before any limitations. What is Kent's taxable income for the year? tal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts