Question: Current Aftempt in Progress Filst - Rate Cleaners is considering replacing one of its tired cleaning machines for a new model that can dry -

Current Aftempt in Progress

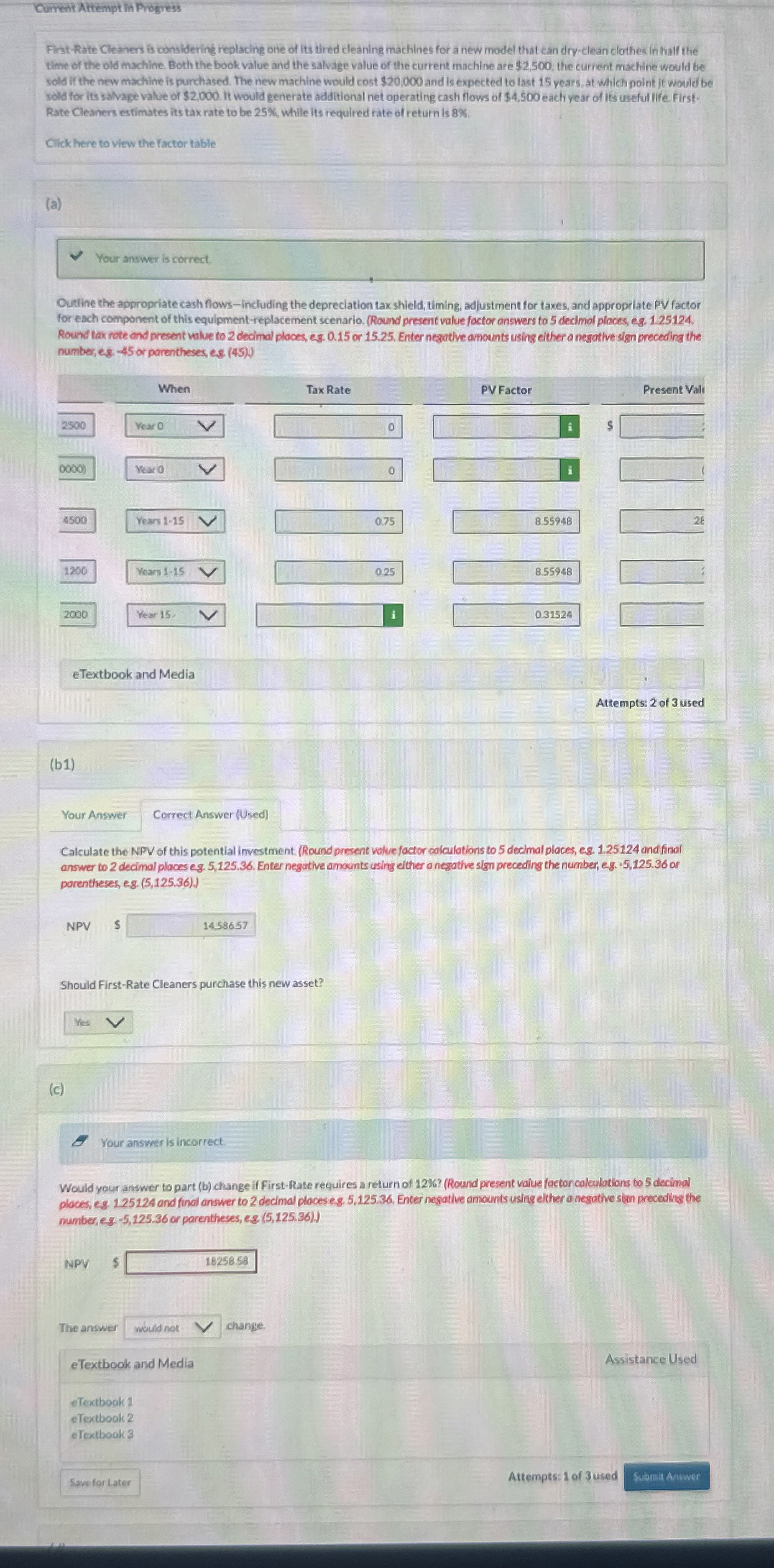

FilstRate Cleaners is considering replacing one of its tired cleaning machines for a new model that can dryclean clothes in half the time of the old machline. Both the book value and the salvage value of the current machine are $; the current machine would be sold if the new machine is punchased. The new machine would cost $ and is expected to last years, at which point it would be sold for its salvage value or $ it would generate additional net operating cash flows of $ each year of its usefullife. FirstRate Cleaners estimates its tax rate to be while its required rate of return

Cick here to view the factor table

a

Your answer is correct.

Outline the appropriate cash flowsincluding the depreciation tax shield, timing, adjustment for taxes, and appropriate PV factor for each component of this equipmentreplacement scenario. Round present value foctor answers to decimol places, eg Round tax rote and present value to decinnal ploces, es or Enter negotive amounts using either a negathe sign preceding the number, es or parentheses, es:

b

Your Answer Correct Answer Used

Calculate the NPV of this potential investment. Round present walue factor colculations to declmal places, e and final answer to dedimal places eg Enter negathve amounts using either a negative sign preceding the number, eg or parentheses, eg

$

Should FirstRate Cleaners purchase this new asset?

c

Your answer is incorrect.

Would your answer to part b change if FirstRate requires a return of Round present value factor calculations to decimal places, eg and final answer to decimal placeseg. Enter negative amounts using elther a negathe sign precedins the number, eg or parentheses, e

NPY $

The answer change.

eTextbook and Media

Assistance Used

eTextbook

eTextbook

eTextbook

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock