Question: Current and Deferred Taxes Accounting principles require us to recognize taxes when they are incurred. However, there is a difference in accounting between standard accounting

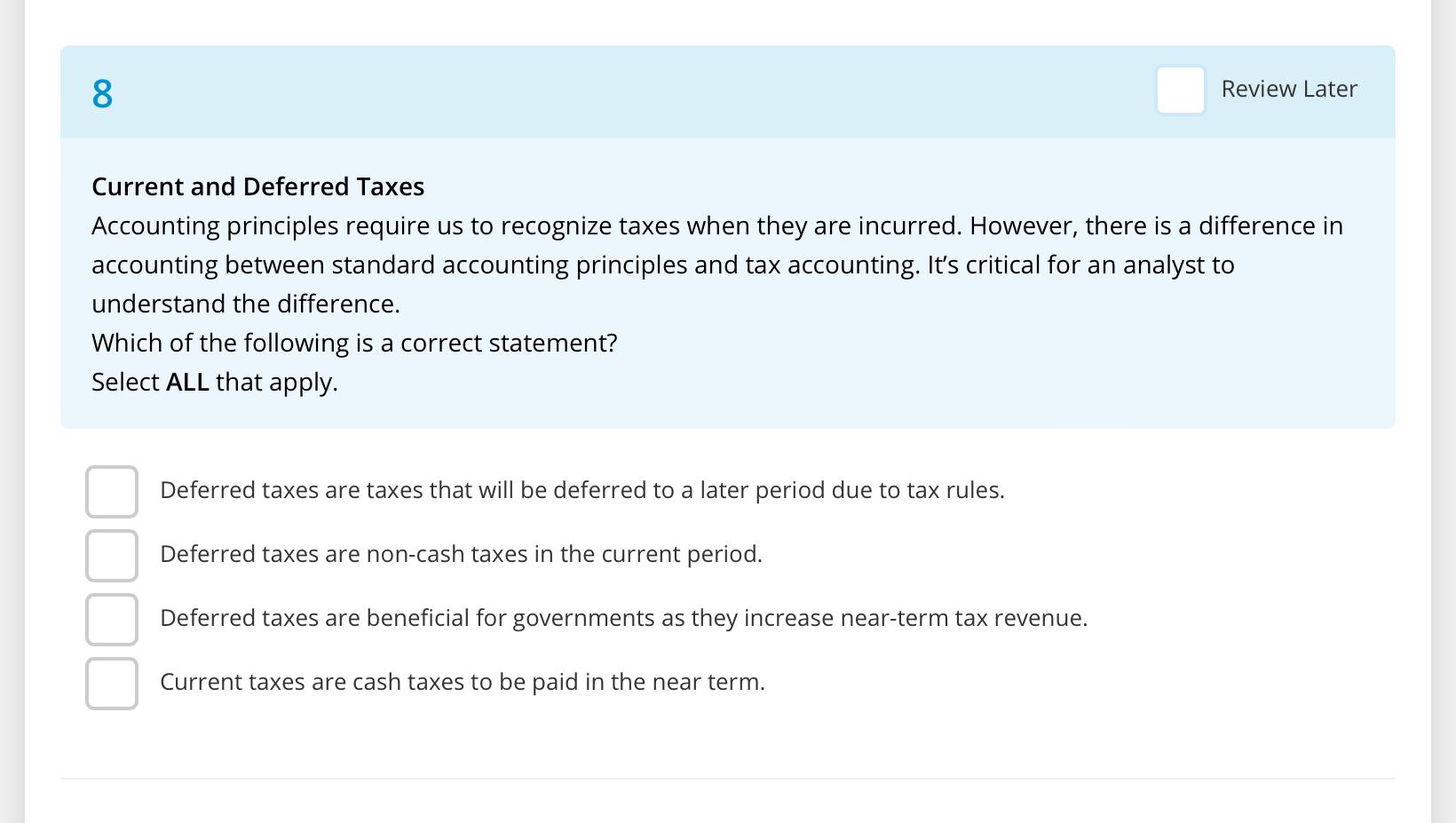

Current and Deferred Taxes

Accounting principles require us to recognize taxes when they are incurred. However, there is a difference in accounting between standard accounting principles and tax accounting. Its critical for an analyst to understand the difference. Which of the following is a correct statement? Select ALL that apply.

A.Deferred taxes are taxes that will be deferred to a later period due to tax rules.

B.Deferred taxes are non-cash taxes in the current period.

C.Deferred taxes are beneficial for governments as they increase near-term tax revenue.

D.Current taxes are cash taxes to be paid in the near term.

Current and Deferred Taxes Accounting principles require us to recognize taxes when they are incurred. However, there is a difference in accounting between standard accounting principles and tax accounting. It's critical for an analyst to understand the difference. Which of the following is a correct statement? Select ALL that apply. Deferred taxes are taxes that will be deferred to a later period due to tax rules. Deferred taxes are non-cash taxes in the current period. Deferred taxes are beneficial for governments as they increase near-term tax revenue. Current taxes are cash taxes to be paid in the near term

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts