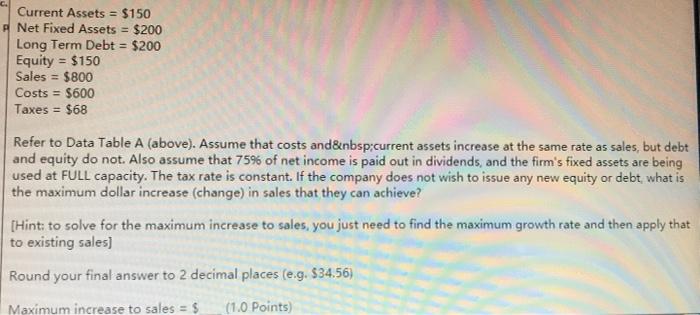

Question: Current Assets = $150 Net Fixed Assets = $200 Long Term Debt = $200 Equity = $150 Sales = $800 Costs = $600 Taxes =

Current Assets = $150 Net Fixed Assets = $200 Long Term Debt = $200 Equity = $150 Sales = $800 Costs = $600 Taxes = $68 Refer to Data Table A (above). Assume that costs and current assets increase at the same rate as sales, but debt and equity do not. Also assume that 75% of net income is paid out in dividends, and the firm's fixed assets are being used at FULL capacity. The tax rate is constant. If the company does not wish to issue any new equity or debt, what is the maximum dollar increase (change) in sales that they can achieve? (Hint: to solve for the maximum increase to sales, you just need to find the maximum growth rate and then apply that to existing sales) Round your final answer to 2 decimal places (e.g. $34.56) Maximum increase to sales = $ (1.0 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts