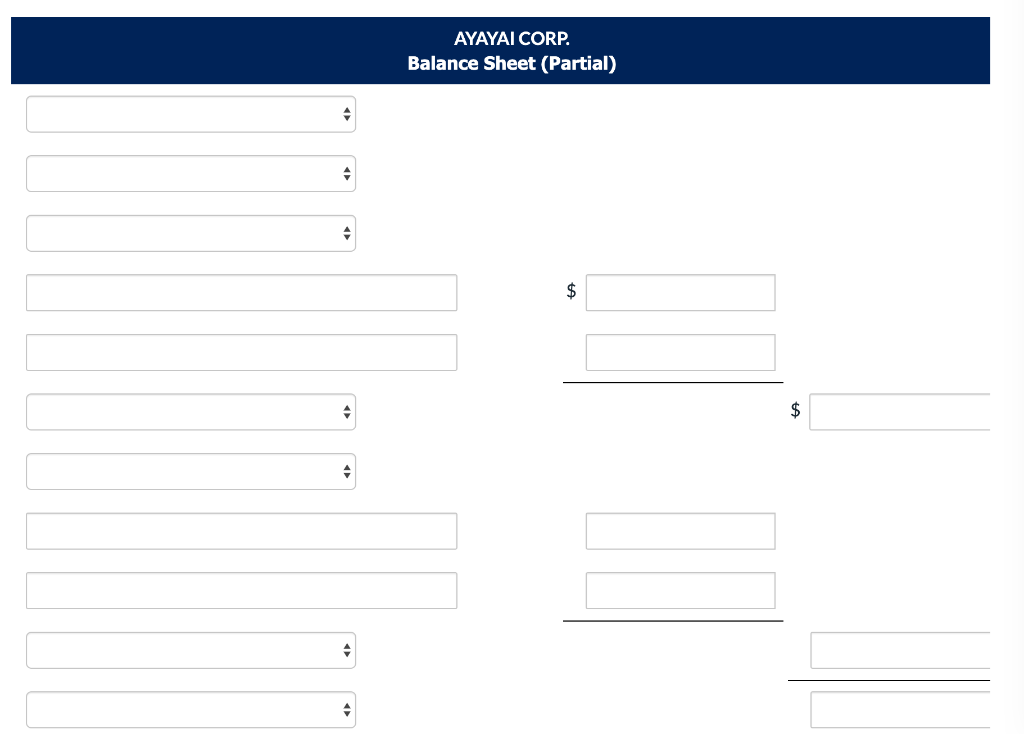

Question: Current Assets Current Liabilities Intangible Assets Long-term Investments Long-term Liabilities Property, plant and Equipment Stockholders' Equity Total Assets Total Current Assets Total Current Liabilities Total

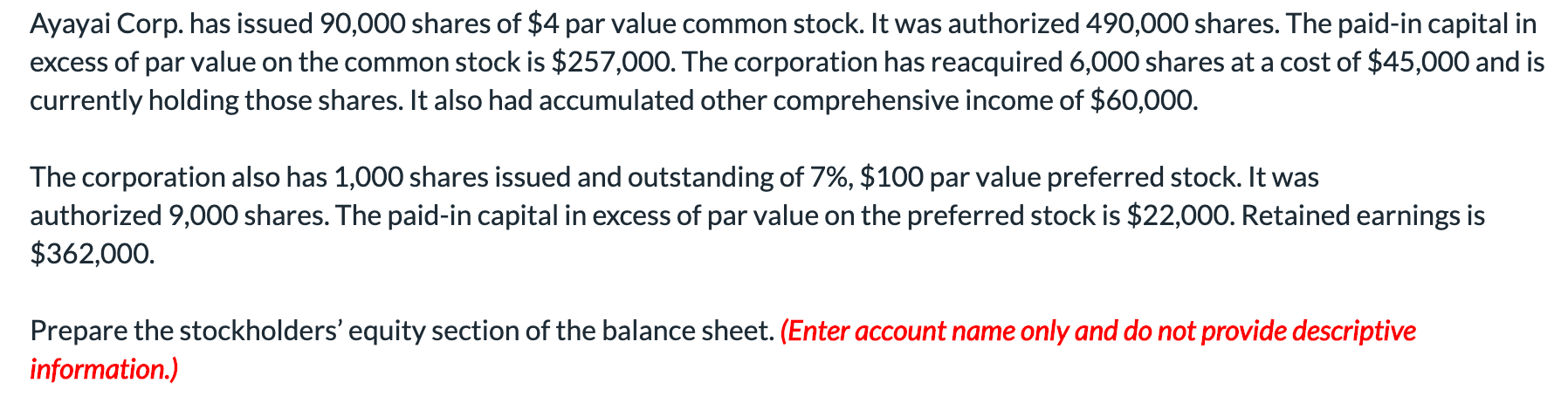

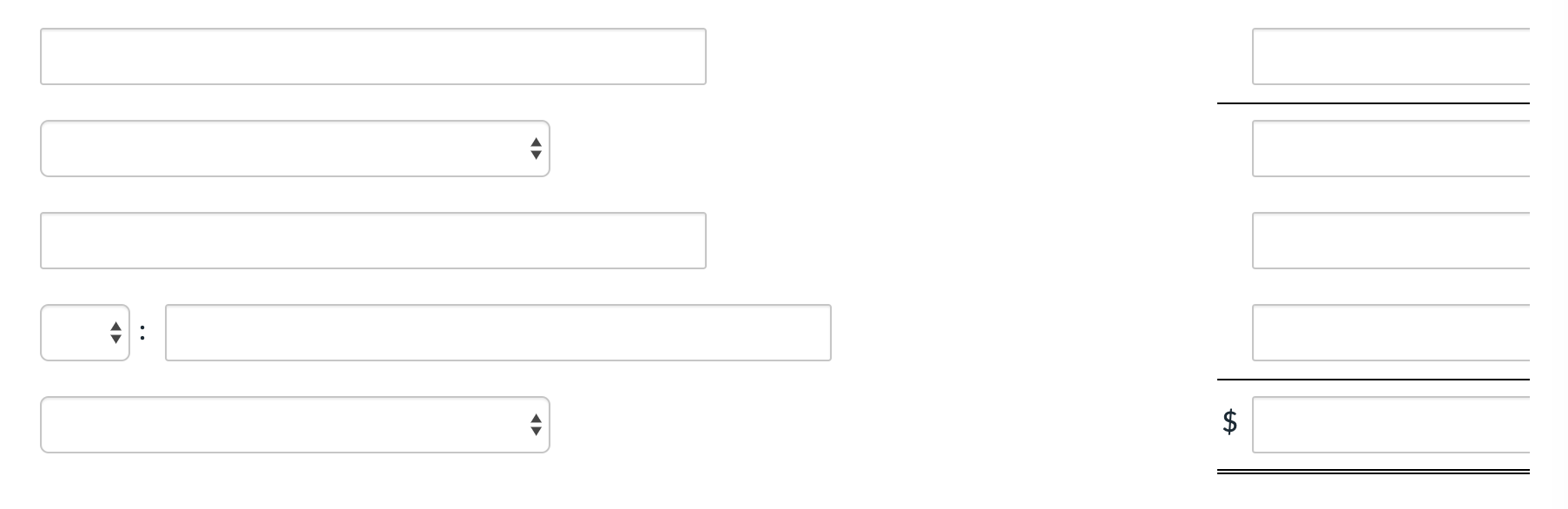

Current Assets Current Liabilities Intangible Assets Long-term Investments Long-term Liabilities Property, plant and Equipment Stockholders' Equity Total Assets Total Current Assets Total Current Liabilities Total Intangible Assets Total Liabilities Total Liabilities and Stockholders' Equity Total Long-term Investments Total Long-term Liabilities Total Property, Plant and Equipment Additional Paid-in Capital Paid-in Capital Capital Stock Total Capital Stock Total Paid-in Capital Total Stockholders' Equity Total Additional Paid-in Capital Total Paid-in Capital and Retained Earnings Ayayai Corp. has issued 90,000 shares of $4 par value common stock. It was authorized 490,000 shares. The paid-in capital in excess of par value on the common stock is $257,000. The corporation has reacquired 6,000 shares at a cost of $45,000 and is currently holding those shares. It also had accumulated other comprehensive income of $60,000. The corporation also has 1,000 shares issued and outstanding of 7%, $100 par value preferred stock. It was authorized 9,000 shares. The paid-in capital in excess of par value on the preferred stock is $22,000. Retained earnings is $362,000. Prepare the stockholders' equity section of the balance sheet. (Enter account name only and do not provide descriptive information.) AYAYAI CORP. Balance Sheet (Partial)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts