Question: Current assets Net fixed assets Total assets Current liabilities Long-term debt Total liabilities Balance Sheet as at December 31, 2021 Shareholders' equity Common stock

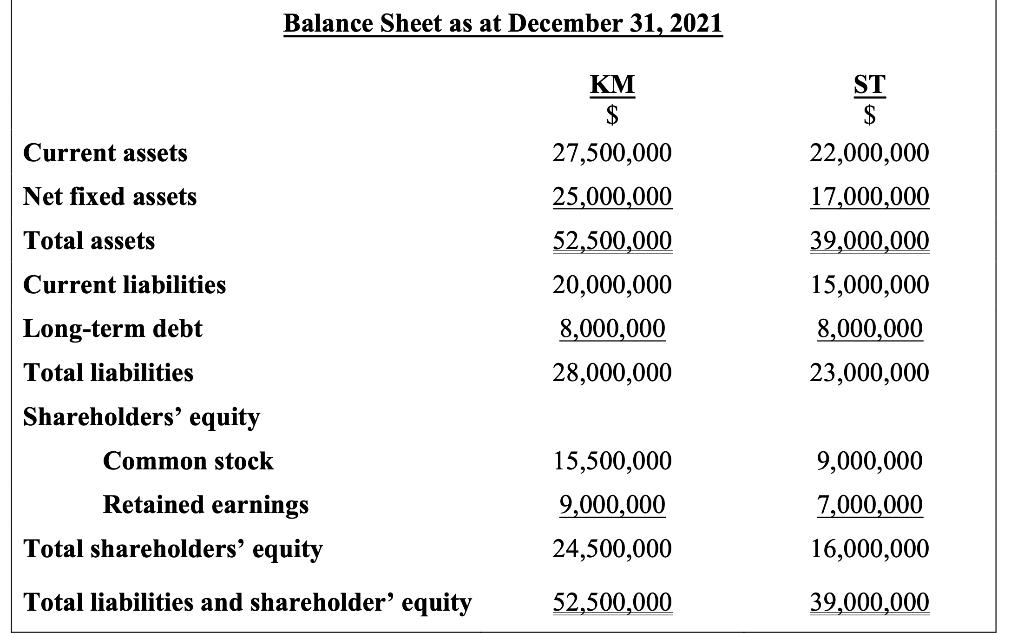

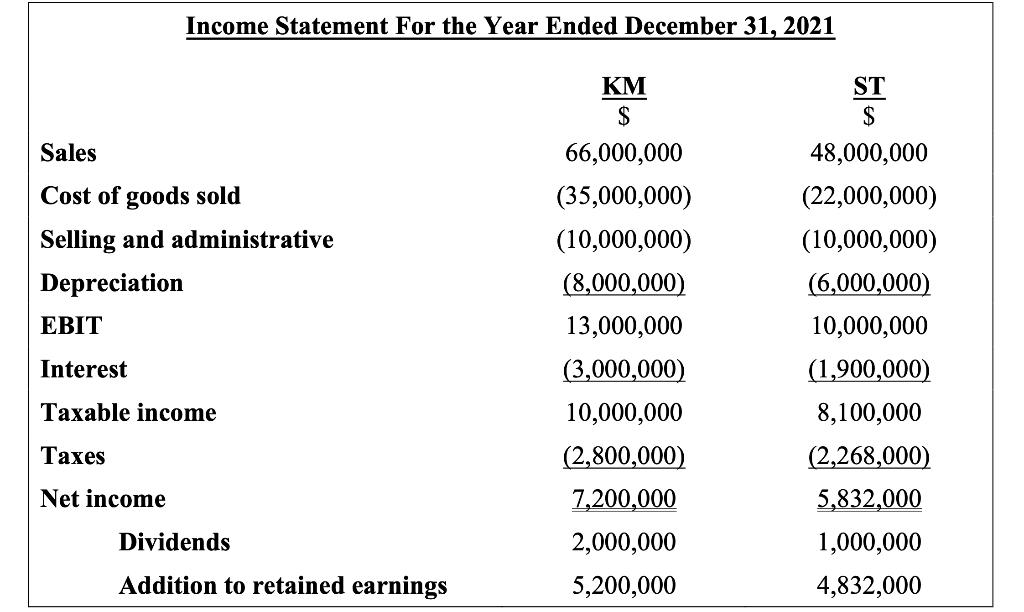

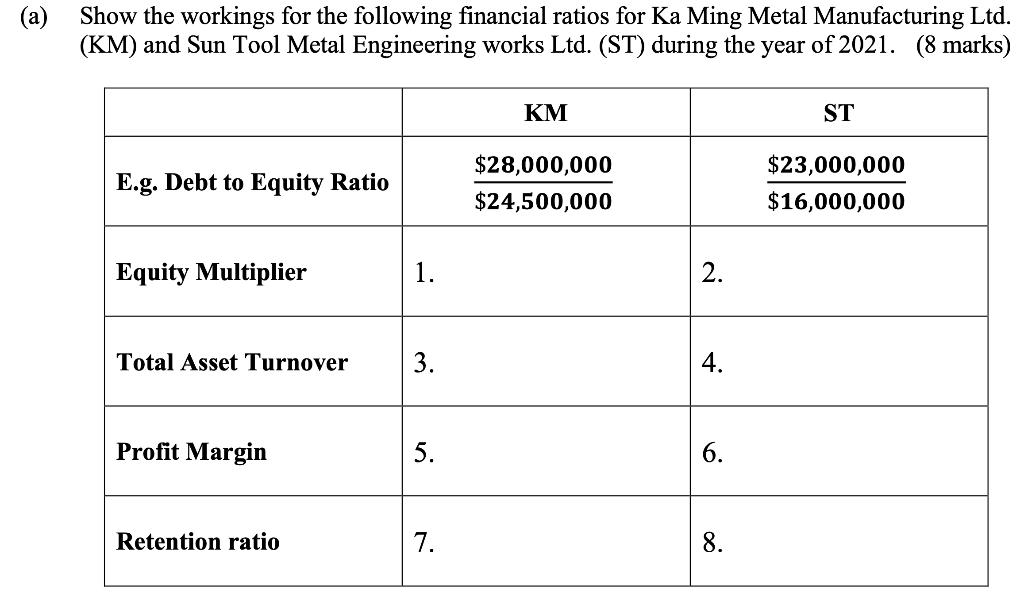

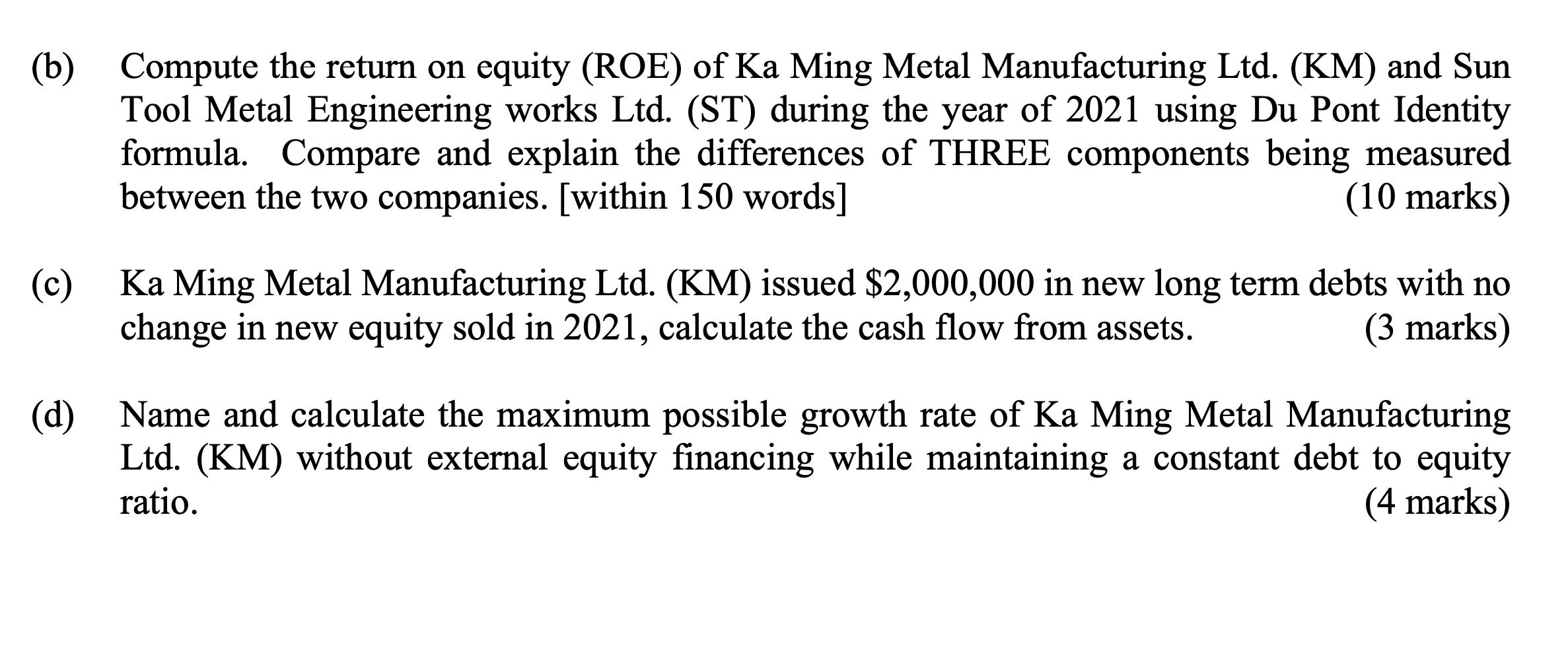

Current assets Net fixed assets Total assets Current liabilities Long-term debt Total liabilities Balance Sheet as at December 31, 2021 Shareholders' equity Common stock Retained earnings Total shareholders' equity Total liabilities and shareholder' equity KM $ 27,500,000 25,000,000 52,500,000 20,000,000 8,000,000 28,000,000 15,500,000 9,000,000 24,500,000 52,500,000 ST $ 22,000,000 17,000,000 39,000,000 15,000,000 8,000,000 23,000,000 9,000,000 7,000,000 16,000,000 39,000,000 Income Statement For the Year Ended December 31, 2021 Sales Cost of goods sold Selling and administrative Depreciation EBIT Interest Taxable income Taxes Net income Dividends Addition to retained earnings KM $ 66,000,000 (35,000,000) (10,000,000) (8,000,000) 13,000,000 (3,000,000) 10,000,000 (2,800,000) 7,200,000 2,000,000 5,200,000 ST $ 48,000,000 (22,000,000) (10,000,000) (6,000,000) 10,000,000 (1,900,000) 8,100,000 (2,268,000) 5,832,000 1,000,000 4,832,000 (a) Show the workings for the following financial ratios for Ka Ming Metal Manufacturing Ltd. (KM) and Sun Tool Metal Engineering works Ltd. (ST) during the year of 2021. (8 marks) E.g. Debt to Equity Ratio Equity Multiplier Total Asset Turnover Profit Margin Retention ratio 1. 3. 7. KM $28,000,000 $24,500,000 2. 4. 6. 8. ST $23,000,000 $16,000,000 (b) Compute the return on equity (ROE) of Ka Ming Metal Manufacturing Ltd. (KM) and Sun Tool Metal Engineering works Ltd. (ST) during the year of 2021 using Du Pont Identity formula. Compare and explain the differences of THREE components being measured between the two companies. [within 150 words] (10 marks) (c) Ka Ming Metal Manufacturing Ltd. (KM) issued $2,000,000 in new long term debts with no change in new equity sold in 2021, calculate the cash flow from assets. (3 marks) (d) Name and calculate the maximum possible growth rate of Ka Ming Metal Manufacturing Ltd. (KM) without external equity financing while maintaining a constant debt to equity ratio. (4 marks)

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts