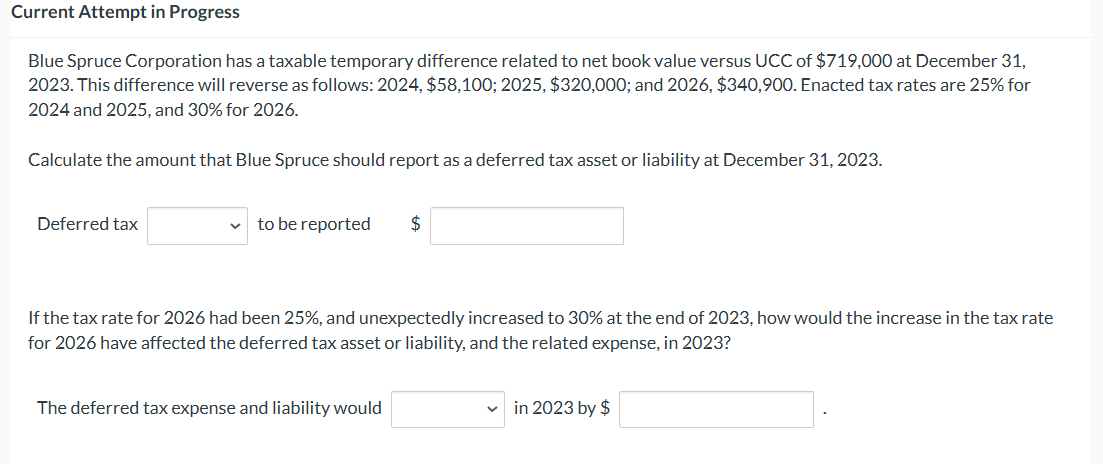

Question: Current Attempt i n Progress Blue Spruce Corporation has a taxable temporary difference related t o net book value versus UCC o f $ 7

Current Attempt Progress

Blue Spruce Corporation has a taxable temporary difference related net book value versus UCC $ December

This difference will reverse follows: $;$; and $ Enacted tax rates are for

and and for

Calculate the amount that Blue Spruce should report a deferred tax asset liability December

Deferred tax

reported

$

the tax rate for had been and unexpectedly increased the end how would the increase the tax rate

for have affected the deferred tax asset liability, and the related expense,

The deferred tax expense and liability would

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock