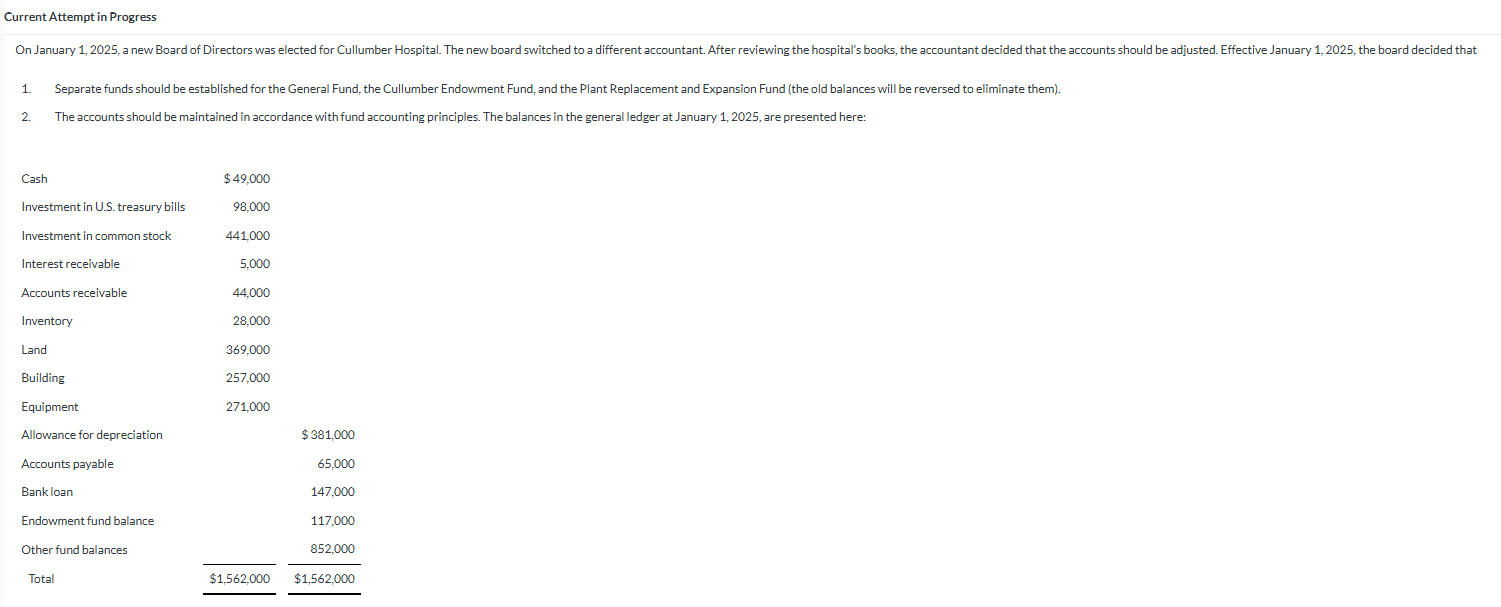

Question: Current Attempt in Progress 1 . Separate funds should be established for the General Fund, the Cullumber Endowment Fund, and the Plant Replacement and Expansion

Current Attempt in Progress Separate funds should be established for the General Fund, the Cullumber Endowment Fund, and the Plant Replacement and Expansion Fund the old balances will be reversed to eliminate them The accounts should be maintained in accordance with fund accounting principles. The balances in the general ledger at January are presented here: begintabularlrr Cash & $ Investment in US treasury bills & Investment in common stock & Interest receivable & Accounts receivable & Inventory & Land & Building & & Equipment & & Allowance for depreciation & & $ Accounts payable & & Bank loan & & Endowment fund balance & & Other fund balances & $ & $ Total & & hline endtabular The following additional information is available:

The Endowment Fund consists of the following:

begintabularlr

Cash received in by bequest from Ethington & $

begintabularl

Net gains realized from through from the sale of real estate

acquired in mortgage foreclosures

endtabular &

begintabularl

Income received from through from day US

treasury bill investments

Balance per general ledger on January

endtabular & begintabularl

hline

hline

endtabular

endtabular

The land account balance is composed of

begintabularlr

begintabularl

A appraisal of land at $ and building at $ received by

donation at that time. The building was demolished in

endtabular & $

begintabularlr

Appraisal increase based on insured value in land title policies

issued in &

Landscaping costs for trees planted &

hline Balance per general ledger on January & underline$

hline

endtabular

endtabular

The building balance is composed of

Cost of present hospital building completed in January when the

begintabularlr

hospital commenced operations & $

Adjustment to record appraised value of building in &

Cost of elevator installed in hospital building in January &

Balance per general ledger on January & $

hline

endtabular The estimated useful lives of the hospital building and the elevator when new were years years remaining and years years remaining respectively. computed on a straightline basis.

A bank loan was obtained to finance the cost of new operating room equipment purchased in Interest was paid to December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock