Question: Current Attempt in Progress A company changes from the straight - line method to an accelerated method of calculating depreciation, which will be similar to

Current Attempt in Progress

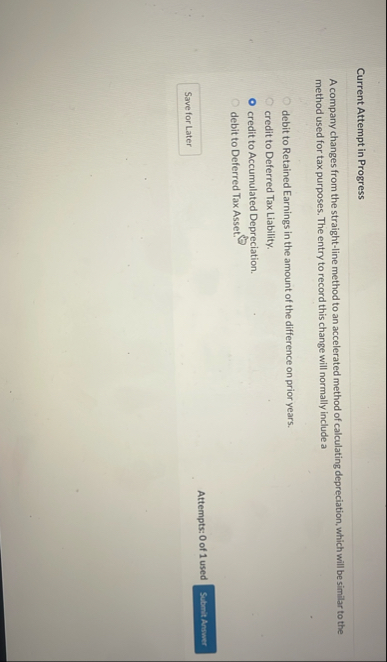

A company changes from the straightline method to an accelerated method of calculating depreciation, which will be similar to the method used for tax purposes. The entry to record this change will normally include a

debit to Retained Earnings in the amount of the difference on prior years.

credit to Deferred Tax Liability.

credit to Accumulated Depreciation.

debit to Deferred Tax Asset.

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock