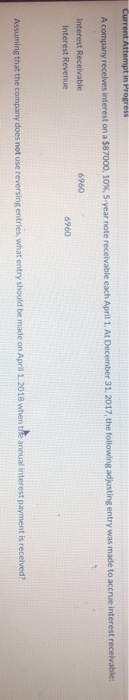

Question: Current Attempt in Progress A company receives interest on a $87000, 10%, 5-year note receivable each April 1. At December 31, 2017, the following adjusting

Current Attempt in Progress A company receives interest on a $87000, 10%, 5-year note receivable each April 1. At December 31, 2017, the following adjusting entry was made to accrue interest receivable: 6960 Interest Receivable Interest Revenue 6960 Assuming that the company does not use reversing entries, what entry should be made on April 1. 2018 when the annual interest payment is received

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock