Question: Current Attempt in Progress A difference in GAAP - based product costing and activity - based costing is that under activity - based costing all

Current Attempt in Progress

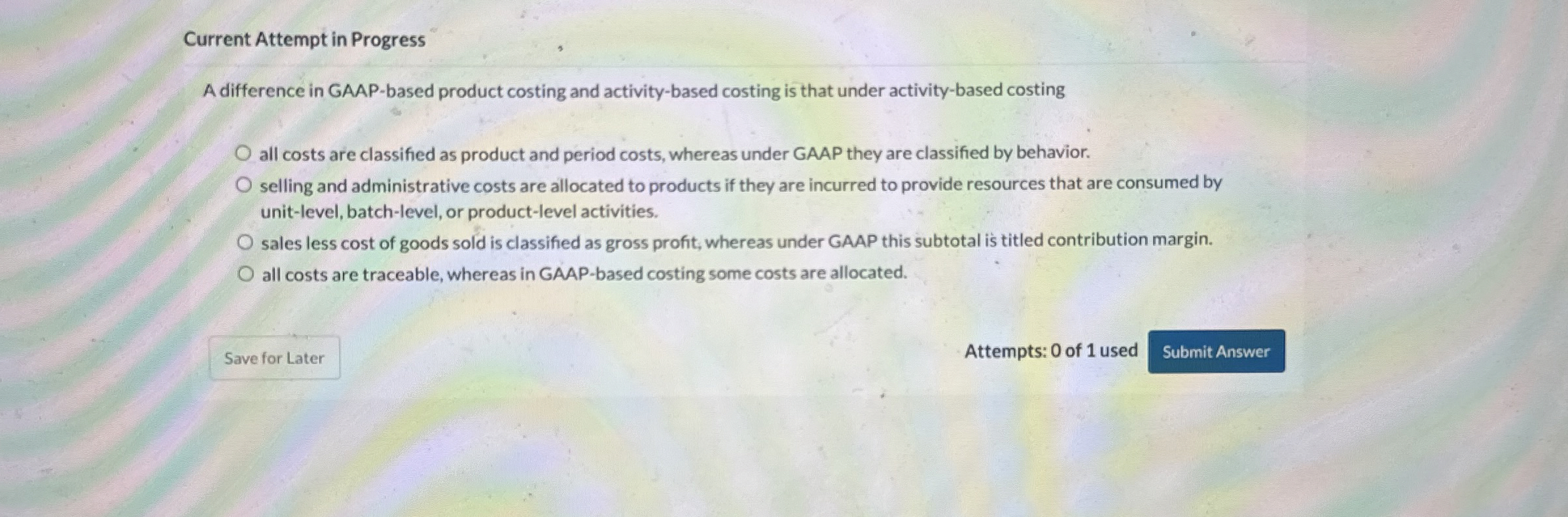

A difference in GAAPbased product costing and activitybased costing is that under activitybased costing

all costs are classified as product and period costs, whereas under GAAP they are classified by behavior.

selling and administrative costs are allocated to products if they are incurred to provide resources that are consumed by unitlevel, batchlevel, or productlevel activities.

sales less cost of goods sold is classified as gross profit, whereas under GAAP this subtotal is titled contribution margin.

all costs are traceable, whereas in GAAPbased costing some costs are allocated.

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock