Question: Current Attempt in Progress A machine costing $56,400 has an estimated useful life of 10 years and a total expected asset life of 12

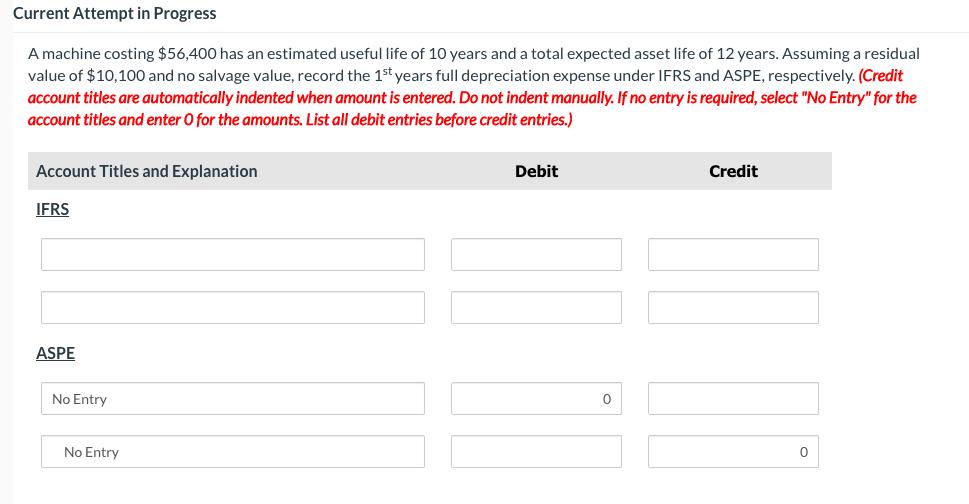

Current Attempt in Progress A machine costing $56,400 has an estimated useful life of 10 years and a total expected asset life of 12 years. Assuming a residual value of $10,100 and no salvage value, record the 1st years full depreciation expense under IFRS and ASPE, respectively. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation IFRS ASPE No Entry No Entry Debit 0 Credit 0

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Answer Full Depreciation expense for the 1st year IFR... View full answer

Get step-by-step solutions from verified subject matter experts