Question: Current Attempt in Progress A machine that produces cellphone components is purchased on January 1 , 2024 , for $134,000. It is expected to have

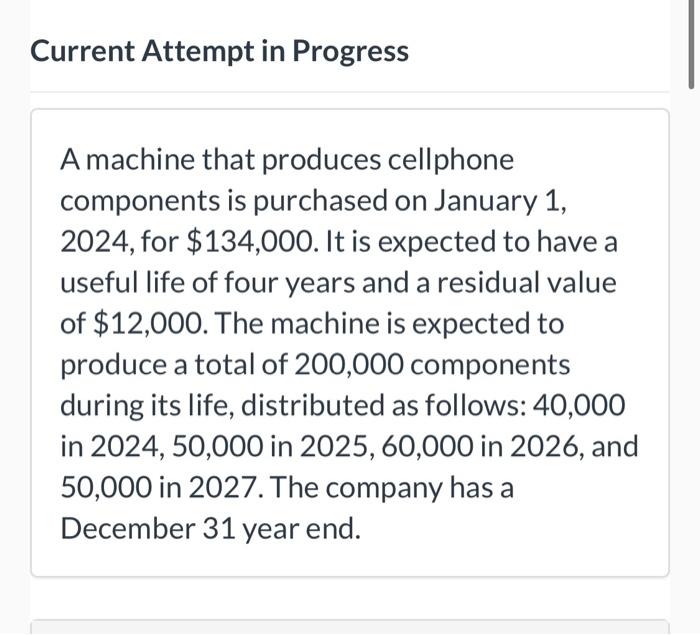

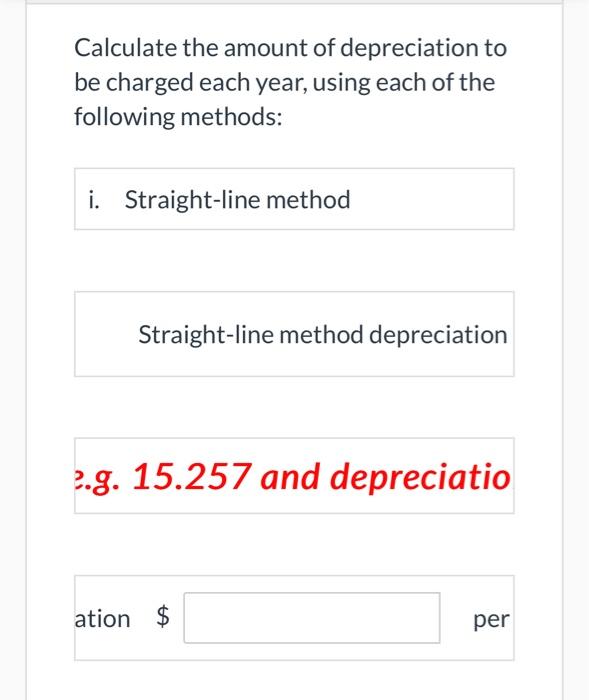

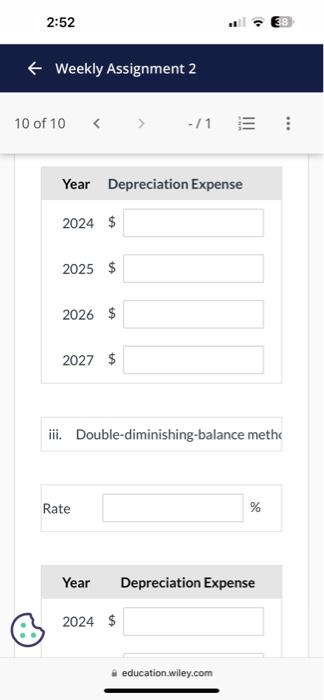

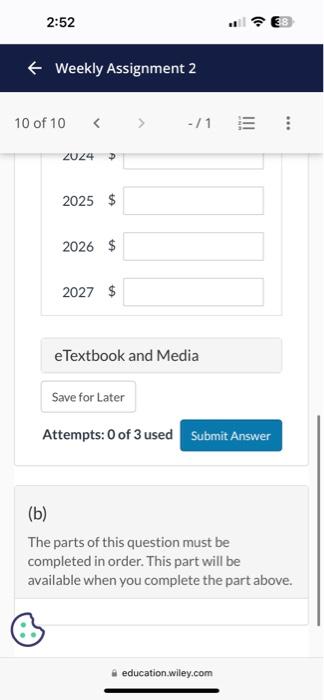

Current Attempt in Progress A machine that produces cellphone components is purchased on January 1 , 2024 , for $134,000. It is expected to have a useful life of four years and a residual value of $12,000. The machine is expected to produce a total of 200,000 components during its life, distributed as follows: 40,000 in 2024,50,000 in 2025,60,000 in 2026 , and 50,000 in 2027 . The company has a December 31 year end. Calculate the amount of depreciation to be charged each year, using each of the following methods: 2:52 E3 Weekly Assignment 2 10 of 10 /1 Year Depreciation Expense 2024$ 2025$ 2026$ 2027$ iii. Double-diminishing-balance methe Rate % Year Depreciation Expense 2024$ education.wiley.com Attempts: 0 of 3 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts