Question: Current Attempt in Progress A net operating loss ( NOL ) occurs for tax purposes in a year when tax - deductible expenses exceed taxable

Current Attempt in Progress

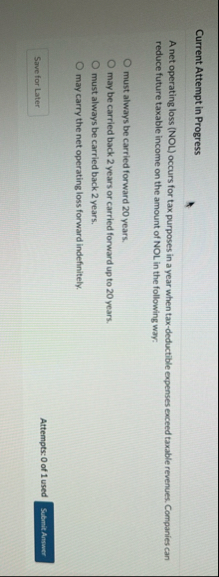

A net operating loss NOL occurs for tax purposes in a year when taxdeductible expenses exceed taxable revenues. Companies can reduce future taxable income on the amount of NOL in the following way:

must always be carried forward years.

may be carried back years or carried forward up to years.

must always be carried back years.

may carry the net operating loss forward indefinitely.

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock