Question: Current Attempt in Progress Anthony Walker and Michelle Hall are examining the following summary of cash flows for Sandhill Company for the year ended January

Current Attempt in Progress

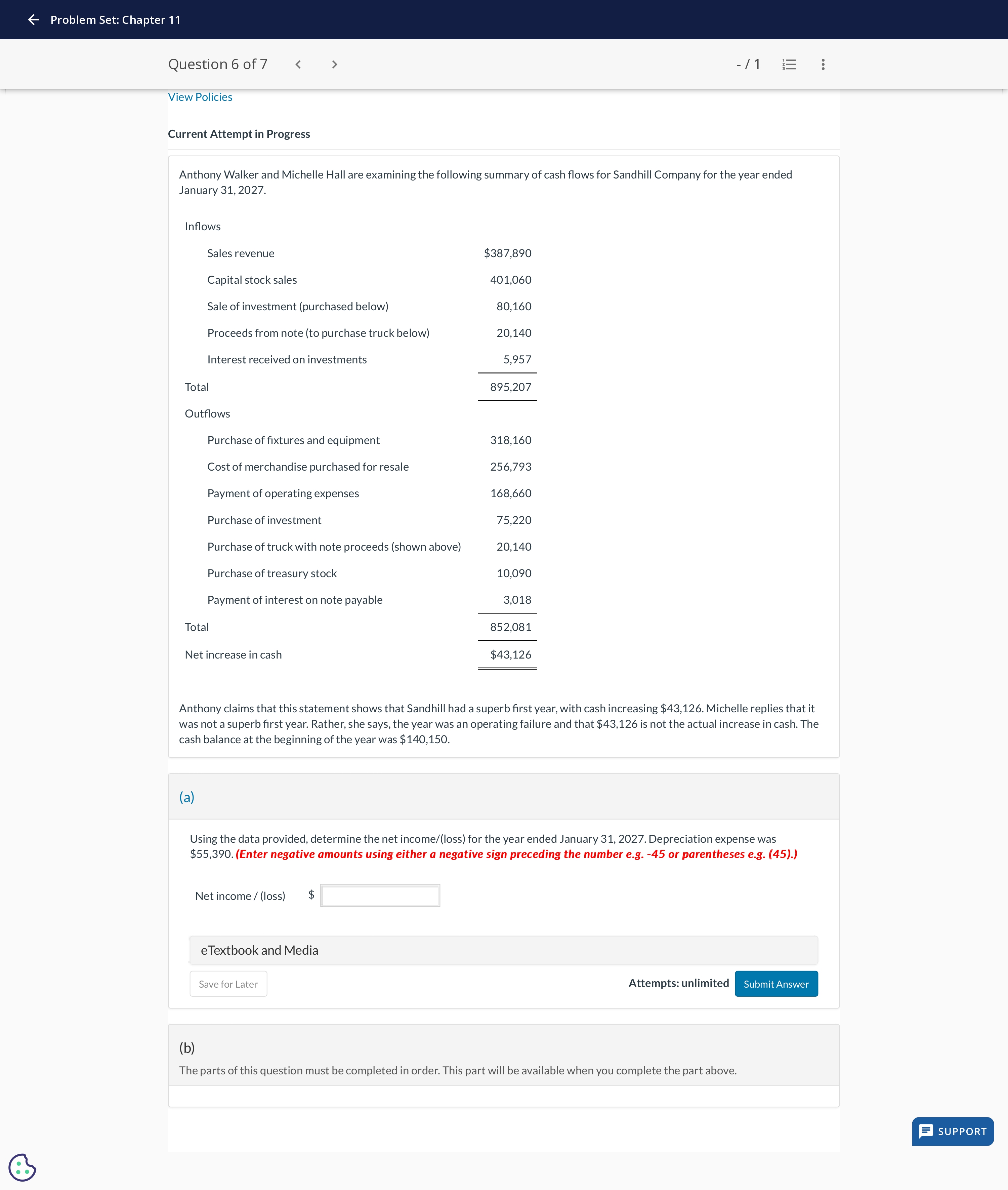

Anthony Walker and Michelle Hall are examining the following summary of cash flows for Sandhill Company for the year ended

January

Inflows

Sales revenue

Capital stock sales

Sale of investment purchased below

Proceeds from note to purchase truck below

Interest received on investments

Total

Outflows

Purchase of fixtures and equipment

Cost of merchandise purchased for resale

Payment of operating expenses

Purchase of investment

Purchase of truck with note proceeds shown above

Purchase of treasury stock

Payment of interest on note payable

Total

Net increase in cash

$

Anthony claims that this statement shows that Sandhill had a superb first year, with cash increasing $ Michelle replies that it

was not a superb first year. Rather, she says, the year was an operating failure and that $ is not the actual increase in cash. The

cash balance at the beginning of the year was $

a

Using the data provided, determine the net incomeloss for the year ended January Depreciation expense was

$Enter negative amounts using either a negative sign preceding the number eg or parentheses eg

Net income loss $

eTextbook and Media

Attempts: unlimited

b

The parts of this question must be completed in order. This part will be available when you complete the part above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock