Question: Current Attempt in Progress At December 31, 2023, the 10% bonds payable of Elizabeth Inc. had a carrying value of $779000. The bonds, which

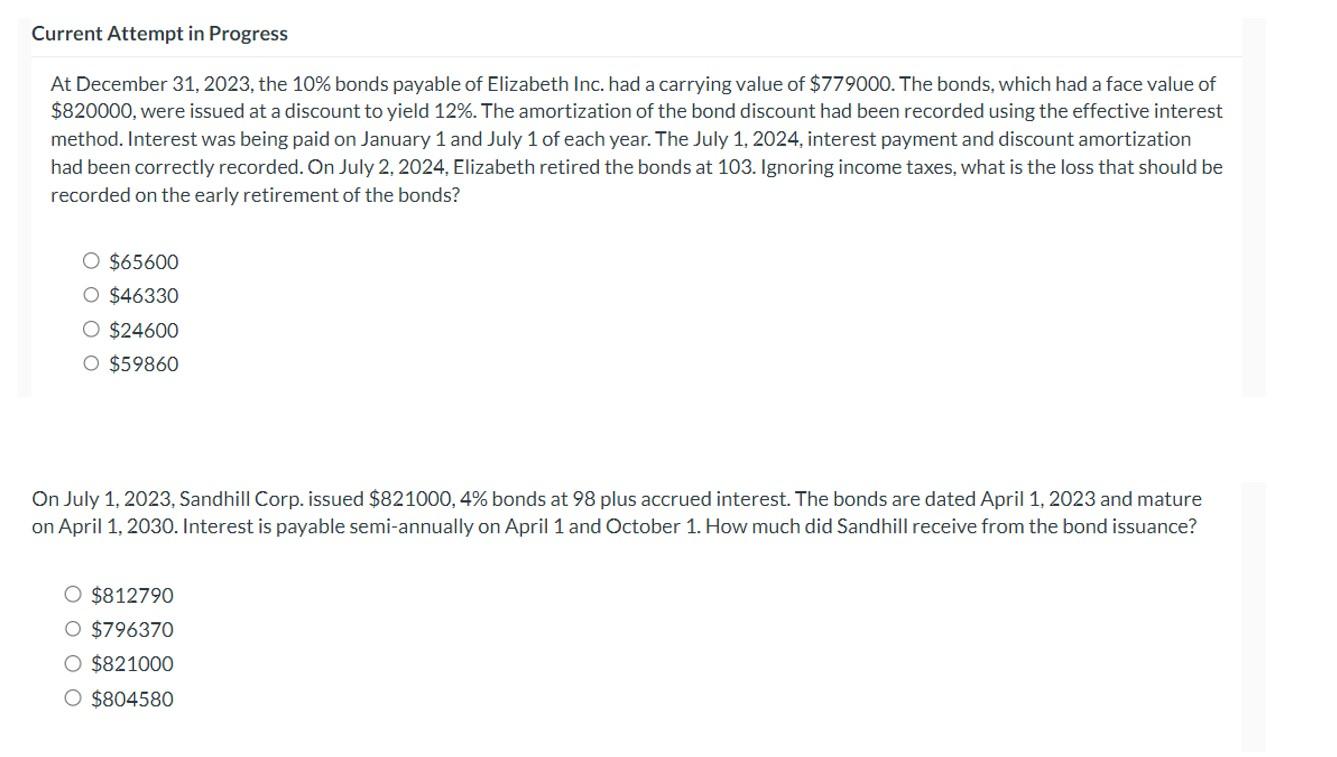

Current Attempt in Progress At December 31, 2023, the 10% bonds payable of Elizabeth Inc. had a carrying value of $779000. The bonds, which had a face value of $820000, were issued at a discount to yield 12%. The amortization of the bond discount had been recorded using the effective interest method. Interest was being paid on January 1 and July 1 of each year. The July 1, 2024, interest payment and discount amortization had been correctly recorded. On July 2, 2024, Elizabeth retired the bonds at 103. Ignoring income taxes, what is the loss that should be recorded on the early retirement of the bonds? $65600 O $46330 $24600 $59860 On July 1, 2023, Sandhill Corp. issued $821000,4% bonds at 98 plus accrued interest. The bonds are dated April 1, 2023 and mature on April 1, 2030. Interest is payable semi-annually on April 1 and October 1. How much did Sandhill receive from the bond issuance? $812790 $796370 $821000 O $804580

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts