Question: Current Attempt in Progress Based on the following transactions, calculate the revenues and expenses that would be reported (a) on the cash basis and

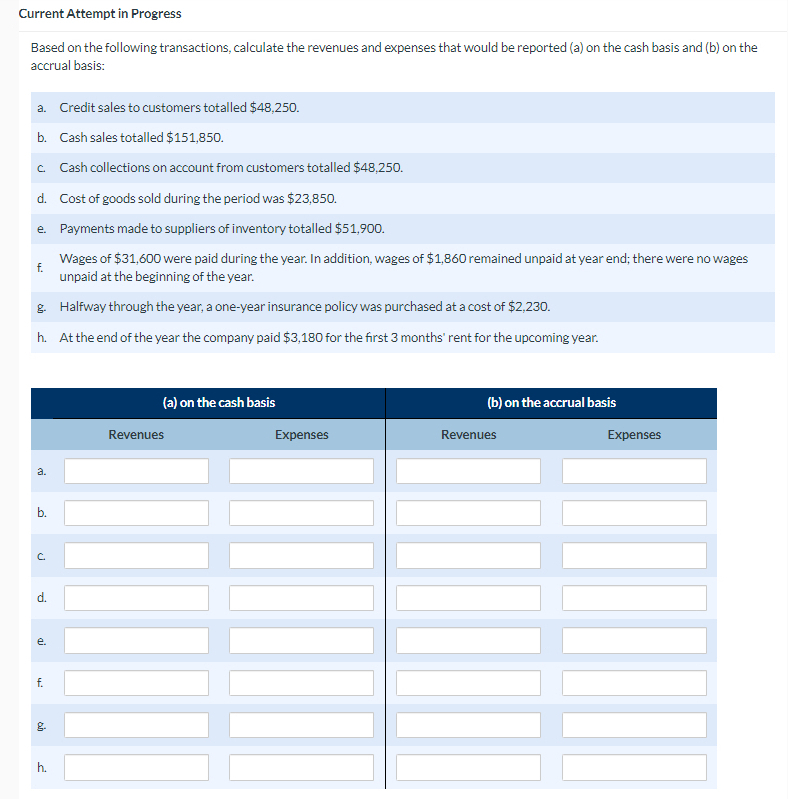

Current Attempt in Progress Based on the following transactions, calculate the revenues and expenses that would be reported (a) on the cash basis and (b) on the accrual basis: a. Credit sales to customers totalled $48,250. b. Cash sales totalled $151,850. c. Cash collections on account from customers totalled $48,250. d. Cost of goods sold during the period was $23,850. e. Payments made to suppliers of inventory totalled $51,900. f. Wages of $31,600 were paid during the year. In addition, wages of $1,860 remained unpaid at year end; there were no wages unpaid at the beginning of the year. g. Halfway through the year, a one-year insurance policy was purchased at a cost of $2,230. h. At the end of the year the company paid $3,180 for the first 3 months' rent for the upcoming year. a. C. d. e. f. g. h. Revenues (a) on the cash basis (b) on the accrual basis Expenses Revenues Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts