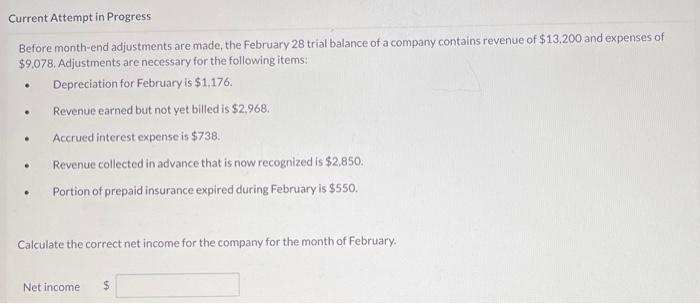

Question: Current Attempt in Progress Before month-end adjustments are made, the February 28 trial balance of a company contains revenue of $13,200 and expenses of $9,078.

Before month-end adjustments are made, the February 28 trial balance of a company contains revenue of $13,200 and expenses of $9,078. Adjustments are necessary for the following items: - Depreciation for February is $1,176. - Revenue earned but not yet billed is $2,968. - Accrued interest expense is $738. - Revenue collected in advance that is now recognized is $2,850. - Portion of prepaid insurance expired during February is $550. Calculate the correct net income for the company for the month of February. Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts