Question: Current Attempt in Progress Blossom Corp. has just made a sale to a British customer. The sale was for a total value of 130,000 and

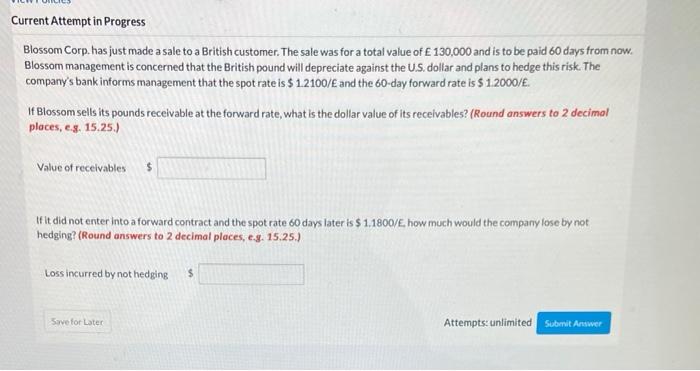

Current Attempt in Progress Blossom Corp. has just made a sale to a British customer. The sale was for a total value of 130,000 and is to be paid 60 days from now. Blossom management is concerned that the British pound will depreciate against the U.S. dollar and plans to hedge this risk. The company's bank informs management that the spot rate is $ 1.2100/and the 60-day forward rate is $ 1.2000/. If Blossom sells its pounds receivable at the forward rate, what is the dollar value of its receivables? (Round answers to 2 decimal places, c.8. 15.25.) Value of receivables $ If it did not enter into a forward contract and the spot rate 60 days later is $ 1.1800/, how much would the company lose by not hedging? (Round answers to 2 decimal places, e.g. 15.25.) Loss incurred by not hedging Sarve for Later Attempts: unlimited Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts