Question: Current Attempt in Progress Blossom Inc. ' s only temporary difference at the beginning and end of 2 0 2 4 is caused by a

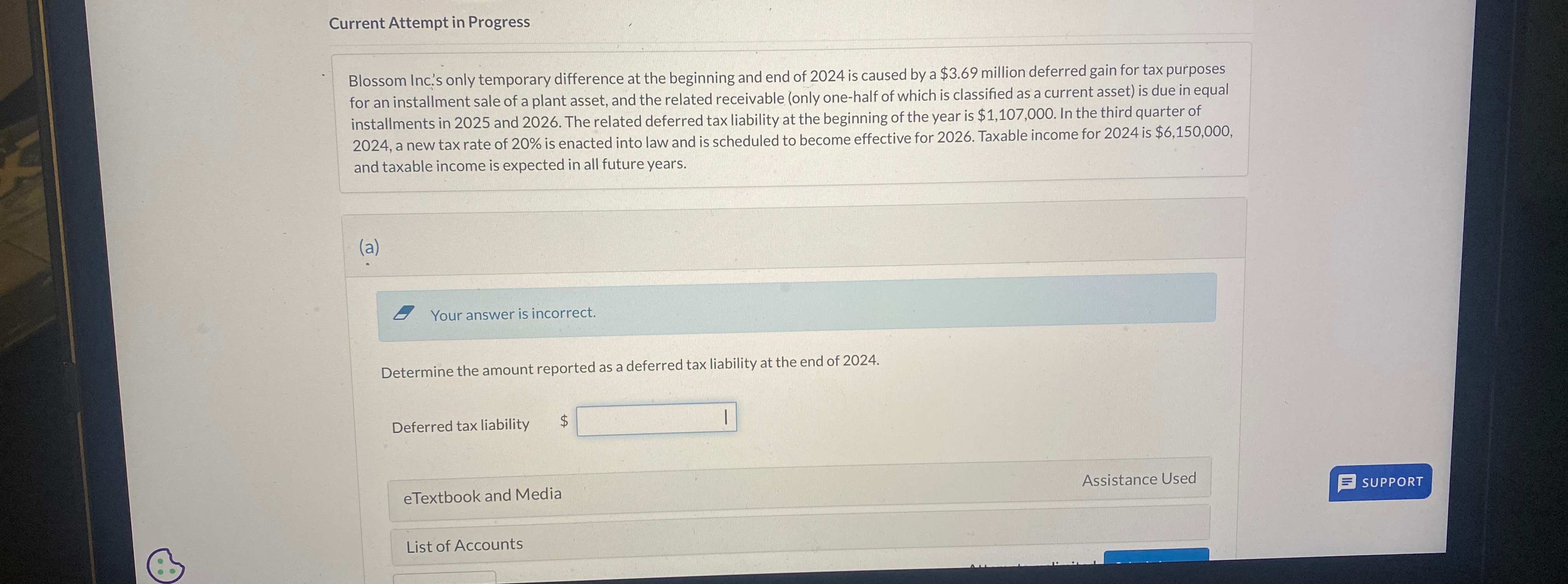

Current Attempt in Progress

Blossom Inc.s only temporary difference at the beginning and end of is caused by a $ million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable only onehalf of which is classified as a current asset is due in equal installments in and The related deferred tax liability at the beginning of the year is $ In the third quarter of a new tax rate of is enacted into law and is scheduled to become effective for Taxable income for is $ and taxable income is expected in all future years.

a

Your answer is incorrect.

Determine the amount reported as a deferred tax liability at the end of

Deferred tax liability $

eTextbook and Media

Assistance Used

List of Accounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock