Question: Current Attempt in Progress Blossom Ltd . purchased a delivery truck on May 1 , 2 0 2 1 , at a cost of $

Current Attempt in Progress

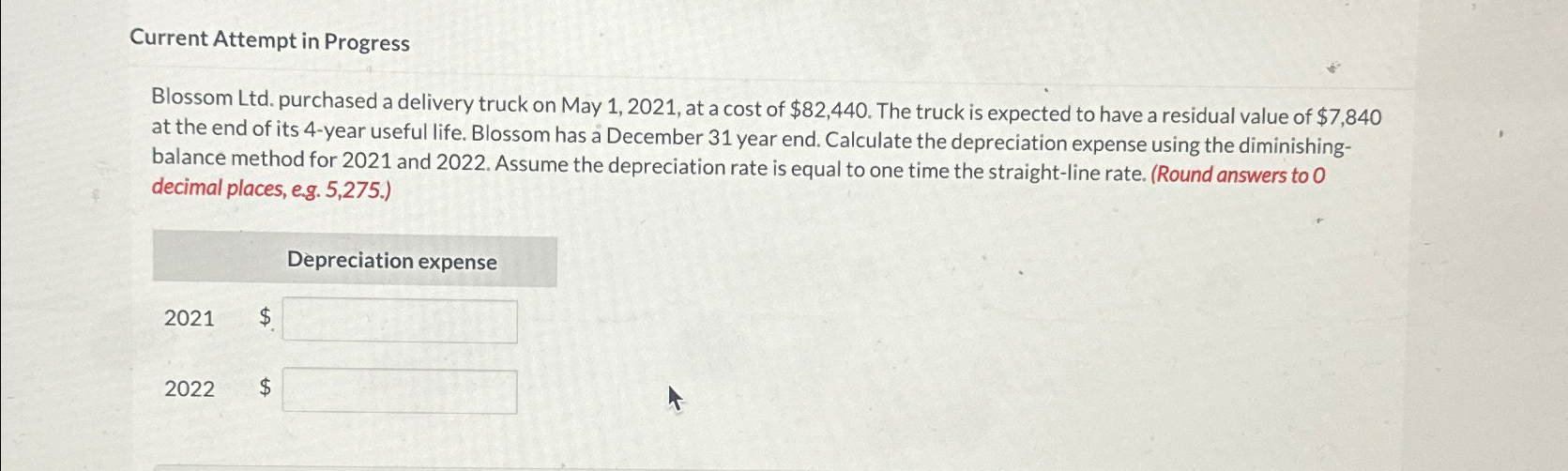

Blossom Ltd purchased a delivery truck on May at a cost of $ The truck is expected to have a residual value of $ at the end of its year useful life. Blossom has a December year end. Calculate the depreciation expense using the diminishingbalance method for and Assume the depreciation rate is equal to one time the straightline rate. Round answers to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock