Question: Current Attempt in Progress Bramble Athletic Wear Inc's adjusted trial balance amounts (with the exclusion of the adjusting entry to update Inventory and Cost of

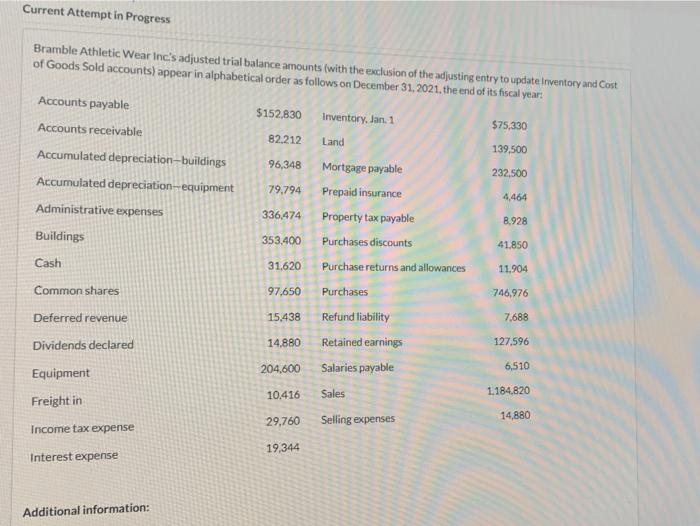

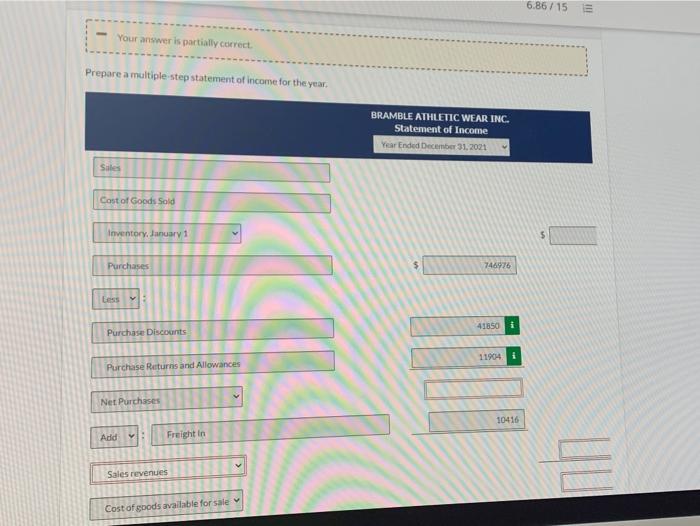

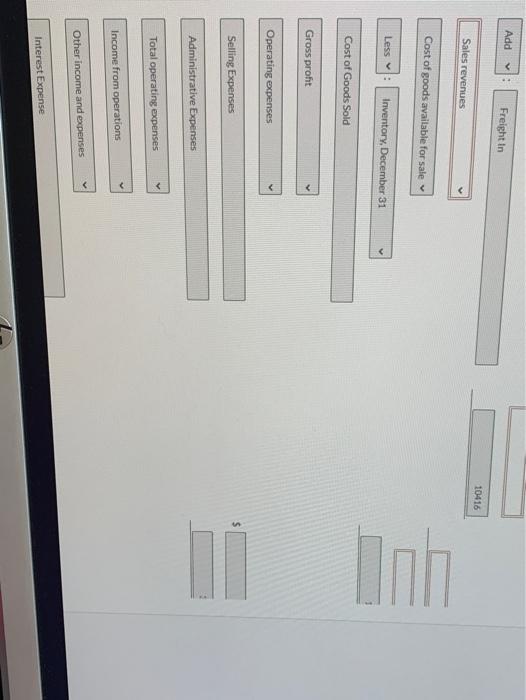

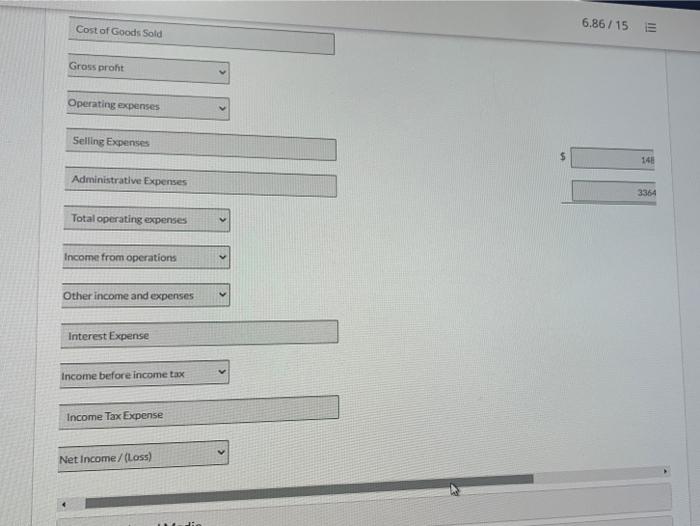

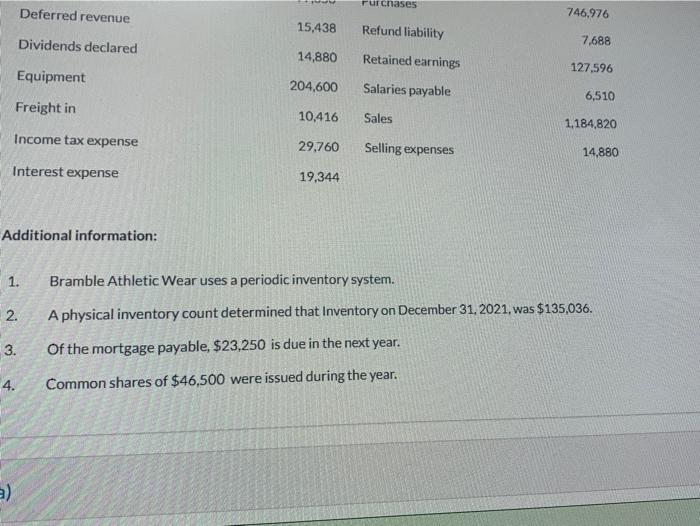

Current Attempt in Progress Bramble Athletic Wear Inc's adjusted trial balance amounts (with the exclusion of the adjusting entry to update Inventory and Cost of Goods Sold accounts) appear in alphabetical order as follows on December 31, 2021, the end of its fiscal year: Accounts payable $152,830 Inventory, Jan. 1 Accounts receivable $75,330 82.212 Land Accumulated depreciation-buildings 139,500 96,348 232.500 Accumulated depreciation equipment Administrative expenses 79,794 4,464 336.474 8.928 Buildings 353.400 41.850 Cash 31.620 Mortgage payable Prepaid insurance Property tax payable Purchases discounts Purchase returns and allowances Purchases Refund liability Retained earnings Salaries payable 11.904 97,650 746,976 Common shares Deferred revenue Dividends declared 15.438 7.688 14,880 127.596 204,600 6,510 Equipment Freight in 10.416 Sales 1,184,820 14,880 29.760 Selling expenses Income tax expense 19,344 Interest expense Additional information: 6.86 / 15 Your answer is partially correct. Prepare a multiple step statement of income for the year, BRAMBLE ATHLETIC WEAR INC. Statement of Income Year Ended December 31, 2021 Sales Cost of Goods Sold Inventory, January 1 Purchases 746976 Eess 41850 1 Purchase Discounts 11904 1 Purchase Returns and Allowances Net Purchases 10416 Add v: Freight in Sales revenues Cost of goods available for sale Add Freight in 10416 Sales revenues Cost of goods available for sale lon Less : Inventory, December 31 Cost of Goods Sold Gross proht Operating expenses Selling Expenses UU Administrative Expenses Total operating expenses Income from operations Other income and expenses Interest Expense Cost of Goods Sold 6.86/15 Gross proht Operating expenses Selling Expenses 14 Administrative Expenses 3364 Total operating expenses Income from operations Other income and expenses Interest Expense Income before income tax Income Tax Expense Net Income/(Loss) Pin Purchases Deferred revenue 746,976 15,438 Refund liability Dividends declared 7,688 14,880 Retained earnings 127,596 Equipment 204,600 Salaries payable 6,510 Freight in 10,416 Sales 1,184,820 Income tax expense 29,760 Selling expenses 14,880 Interest expense 19,344 Additional information: 1. Bramble Athletic Wear uses a periodic inventory system. 2. A physical inventory count determined that Inventory on December 31, 2021, was $135,036. 3. Of the mortgage payable, $23,250 is due in the next year. 4. Common shares of $46,500 were issued during the year. 3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts