Question: Current Attempt in Progress Bridgeport Limited has a calendar year accounting period. The following errors were discovered in 2020 1. The December 31, 2018 merchandise

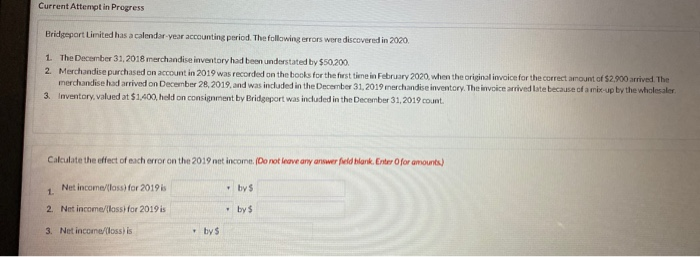

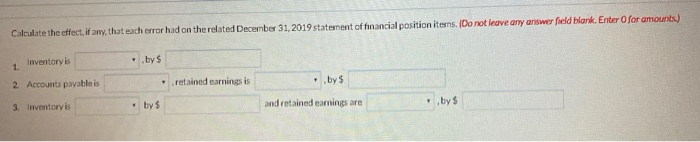

Current Attempt in Progress Bridgeport Limited has a calendar year accounting period. The following errors were discovered in 2020 1. The December 31, 2018 merchandise inventory had been understated by $50.200. 2. Merchandise purchased on account in 2019 was recorded on the books for the first time in February 2020, when the original invoice for the correct out of 52.900 arrived. The merchandise had arrived on December 28, 2019, and was included in the December 31, 2019 merchandise inventory. The invoice arrived ate because of me up by the wholesale 3. Inventory.valued at $1,400, held on consignment by Bridgeport was included in the December 31, 2019 count. Calculate the effect of each error on the 2019 net income. (Do not leave any are don e for amounts) Net income/loss) for 2019 by s 2. Net income/floss for 2019 is by $ 3. Net incomalossi bys Calculate the effect, if any, that each error had on the related December 31, 2019 statement of financial position items. (Do not leave any answer field blank. Enter for amounts 1. Inventory is .bys 2 Accounts payable is retained earnings is . by 3. Inventory is by $ and retained earnings are bys

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts