Question: Current Attempt in Progress Byron, a cash basis taxpayer, repairs computers. On December 2 3 , XXO 2 , one of his long - standing

Current Attempt in Progress

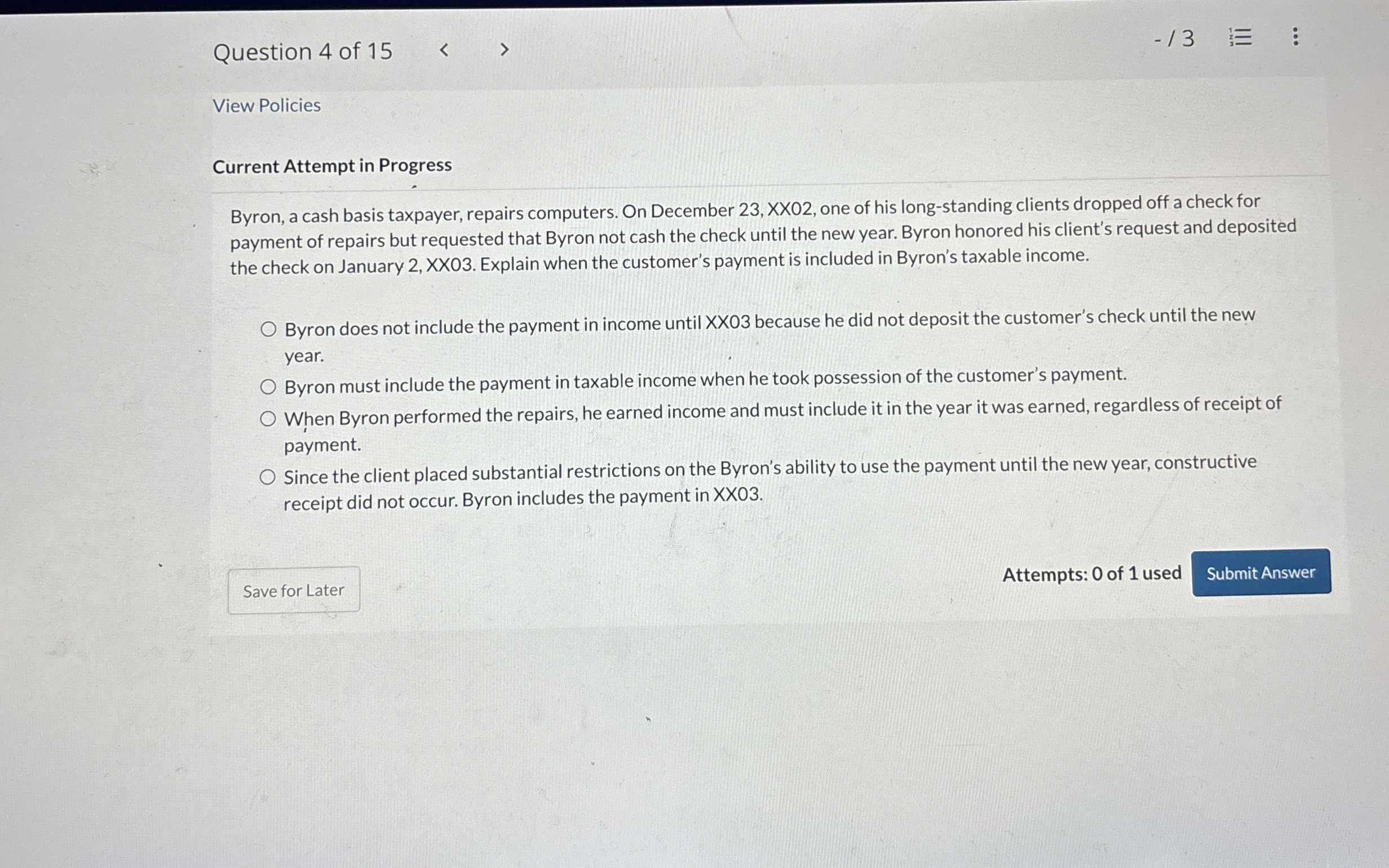

Byron, a cash basis taxpayer, repairs computers. On December XXO one of his longstanding clients dropped off a check for

payment of repairs but requested that Byron not cash the check until the new year. Byron honored his client's request and deposited

the check on January XXO Explain when the customer's payment is included in Byron's taxable income.

Byron does not include the payment in income until XXO because he did not deposit the customer's check until the new

year.

Byron must include the payment in taxable income when he took possession of the customer's payment.

When Byron performed the repairs, he earned income and must include it in the year it was earned, regardless of receipt of

payment.

Since the client placed substantial restrictions on the Byron's ability to use the payment until the new year, constructive

receipt did not occur. Byron includes the payment in XXO

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock