Question: Current Attempt in Progress Crane Enterprises Ltd . , a private company following ASPE earned accounting income before taxes of $ 1 , 7

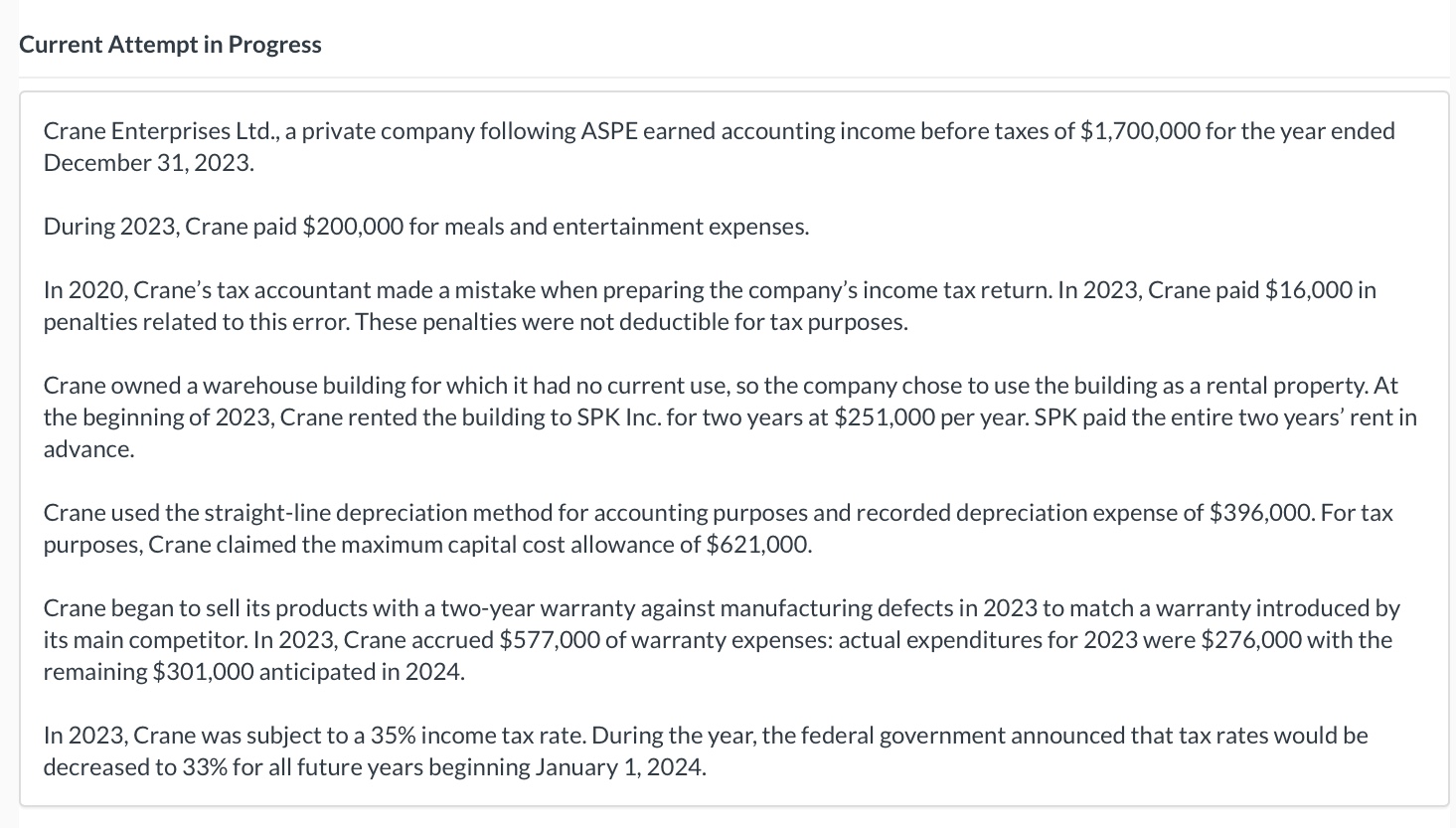

Current Attempt in Progress Crane Enterprises Ltd a private company following ASPE earned accounting income before taxes of $ for the year ended December During Crane paid $ for meals and entertainment expenses. In Crane's tax accountant made a mistake when preparing the company's income tax return. In Crane paid $ in penalties related to this error. These penalties were not deductible for tax purposes. Crane owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At the beginning of Crane rented the building to SPK Inc. for two years at $ per year. SPK paid the entire two years' rent in advance. Crane used the straightline depreciation method for accounting purposes and recorded depreciation expense of $ For tax purposes, Crane claimed the maximum capital cost allowance of $ Crane began to sell its products with a twoyear warranty against manufacturing defects in to match a warranty introduced by its main competitor. In Crane accrued $ of warranty expenses: actual expenditures for were $ with the remaining $ anticipated in In Crane was subject to a income tax rate. During the year, the federal government announced that tax rates would be decreased to for all future years beginning January

Solve all the steps for this one

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock