Question: Current Attempt in Progress Crane Manufacturing management is considering overhauling their existing line, which currently has both a book value and a salvage value of

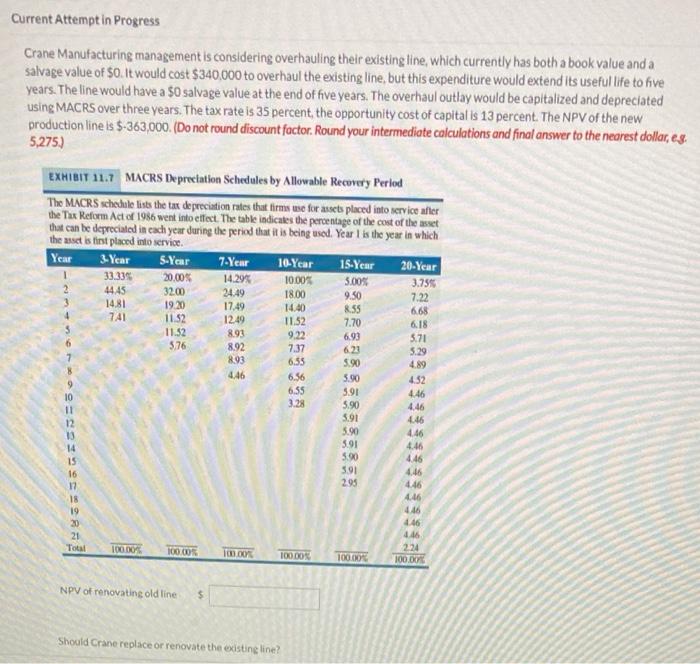

Current Attempt in Progress Crane Manufacturing management is considering overhauling their existing line, which currently has both a book value and a salvage value of $0. It would cost $340,000 to overhaul the existing line, but this expenditure would extend its useful life to five years. The line would have a $0 salvage value at the end of five years. The overhaul outlay would be capitalized and depreciated using MACRS Over three years. The tax rate is 35 percent, the opportunity cost of capital is 13 percent. The NPV of the new production line is $-363,000. (Do not round discount factor. Round your intermediate calculations and final answer to the nearest dollar, es. 5,275.) Year EXHIBIT 11.7 MACRS Depreciation Schedules by Allowable Recovery Perlod The MACRS schedule lists the tar depreciation rates that firms use for assets placed into service after the Tax Reform Act of 1986 went into effect. The table indicates the percentage of the cost of the met that can be depreciated in each year during the period that it is being used. Year 1 is the year in which the set is tirst placed into service 3-Year S-Year 7-Year 10-Year 1S-Year 20-Year 1 33.33% 20.00% 14.29% 10.00% 5.00% 3.755 2 4445 32.00 24.49 18.00 9.50 7.22 3 14.81 19.20 17.49 14.00 8.55 6.68 4 741 11.52 12.49 11.52 7.70 6.18 11.32 8.93 9.22 6.93 3.71 5.76 8.92 7.37 621 3.29 8.93 6.55 5.90 4.89 4.46 6.56 5.90 4.32 9 6.55 5.91 10 4.46 3.28 5.90 5.91 446 12 5.90 4.46 13 5.91 14 4.46 15 4.46 16 591 12 295 4.46 18 4.46 19 416 20 46 21 16 100 DO 224 100.00% 10.00 100 DO 100.00 100.00 4.46 5.90 4.46 Total NPV of renovating old line $ Should Crane replace or renovate the existing line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts