Question: Current Attempt in Progress Cullumber Corp. reported the following differences between SFP carrying amounts and tax bases at December 3 1 , 2 0 2

Current Attempt in Progress

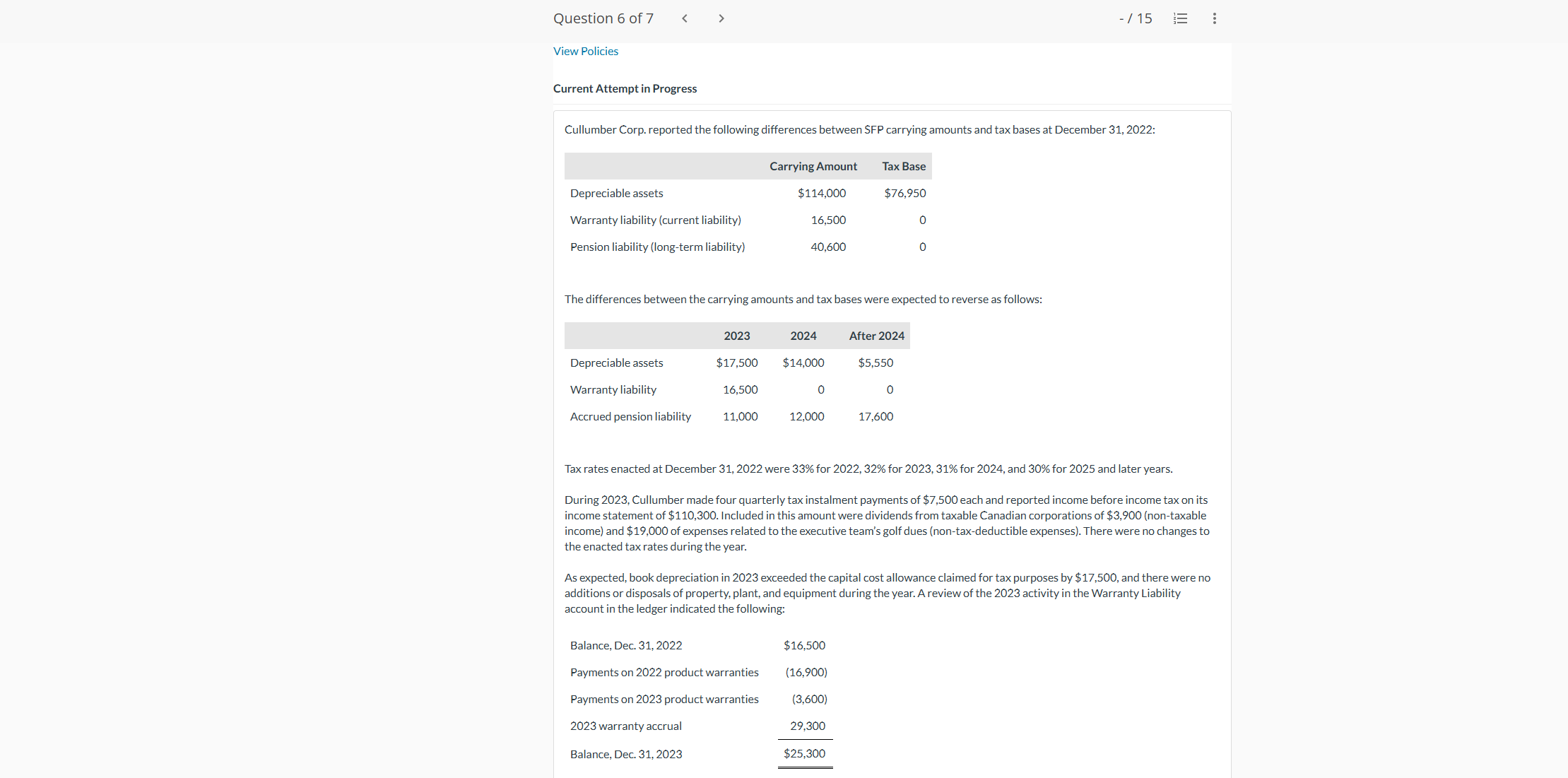

Cullumber Corp. reported the following differences between SFP carrying amounts and tax bases at December :

The differences between the carrying amounts and tax bases were expected to reverse as follows:

Tax rates enacted at December were for for for and for and later years.

During Cullumber made four quarterly tax instalment payments of $ each and reported income before income tax on its income statement of $ Included in this amount were dividends from taxable Canadian corporations of $nontaxable income and $ of expenses related to the executive team's golf dues nontaxdeductible expenses There were no changes to the enacted tax rates during the year.

As expected, book depreciation in exceeded the capital cost allowance claimed for tax purposes by $ and there were no additions or disposals of property, plant, and equipment during the year. A review of the activity in the Warranty Liability account in the ledger indicated the following:

All warranties are valid for one year only. The Pension Liability account reported the following activity:

Pension expenses are deductible for tax purposes, but only as they are paid to the trustee, not as they are accrued for financial reporting purposes.

Cullumber reports under IFRS.

a

Calculate the Deferred Tax Asset or Deferred Tax Liability account at December

Deferred tax

eTextbook and Media

List of Accounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock