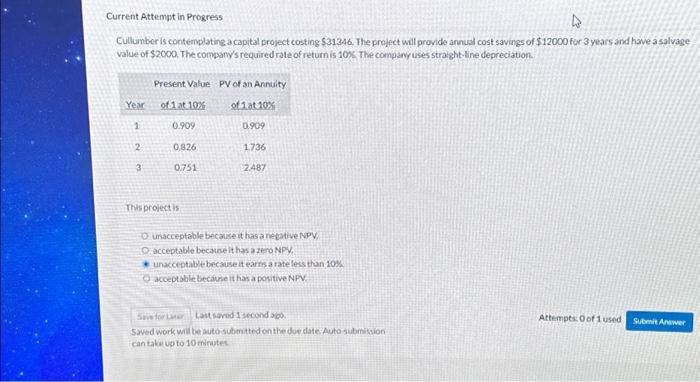

Question: Current Attempt in Progress Cullumber is contemplating a capital project costing $31346. The project will provide annual cost savings of $12000 for 3 years and

Cullumber is contemplating a capital project costing $31346. The project will provide annul cost savings of $12000 for 3 years and have a salvage value of $2000. The company's required rate of return is 10%. The companyuses straght-Ene depreciation Thisproject is unacceptable becare it has a netive NpP. acceptable becarne ithas a zero NPV. unacceptablebecase it earm a rate less than 10% acceptable becaneithas a ponitive NPV. Lautsarod 1 iecond yew. Attempes of of 1 used Saved wark will be sutoisubmitted on the due date Auto submision ican take up to 10 minutes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts