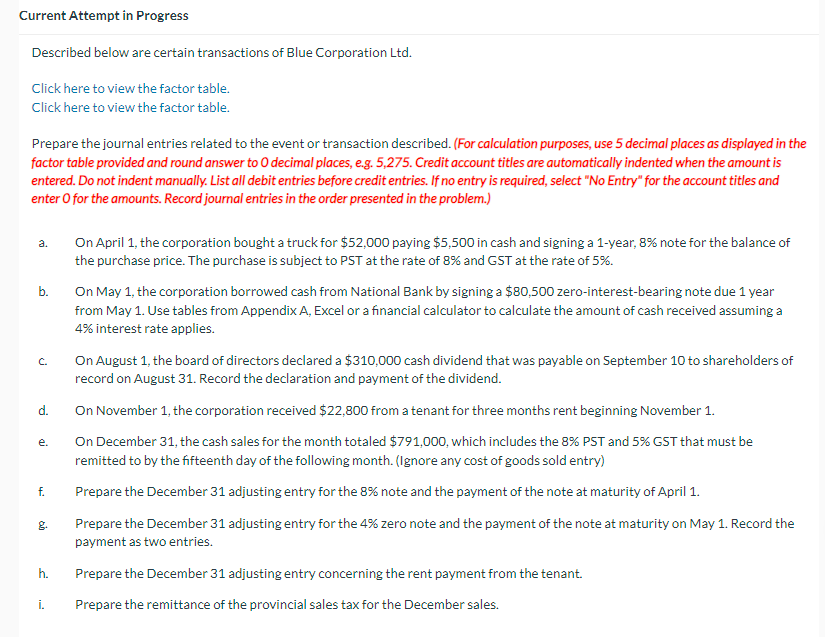

Question: Current Attempt in Progress Described below are certain transactions of Blue Corporation Ltd . Click here to view the factor table. Click here to view

Current Attempt in Progress

Described below are certain transactions of Blue Corporation Ltd

Click here to view the factor table.

Click here to view the factor table.

Prepare the journal entries related to the event or transaction described. For calculation purposes, use decimal places as displayed in the

factor table provided and round answer to decimal places, eg Credit account titles are automatically indented when the amount is

entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select No Entry" for the account titles and

enter for the amounts. Record journal entries in the order presented in the problem.

a On April the corporation bought a truck for $ paying $ in cash and signing a year, note for the balance of

the purchase price. The purchase is subject to PST at the rate of and GST at the rate of

b On May the corporation borrowed cash from National Bank by signing a $ zerointerestbearing note due year

from May Use tables from Appendix A Excel or a financial calculator to calculate the amount of cash received assuming a

interest rate applies.

c On August the board of directors declared a $ cash dividend that was payable on September to shareholders of

record on August Record the declaration and payment of the dividend.

d On November the corporation received $ from a tenant for three months rent beginning November

e On December the cash sales for the month totaled $ which includes the PST and GST that must be

remitted to by the fifteenth day of the following month. Ignore any cost of goods sold entry

f Prepare the December adjusting entry for the note and the payment of the note at maturity of April

g Prepare the December adjusting entry for the zero note and the payment of the note at maturity on May Record the

payment as two entries.

h Prepare the December adjusting entry concerning the rent payment from the tenant.

i Prepare the remittance of the provincial sales tax for the December sales.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock