Question: Current Attempt in Progress Fink Co . is interested in purchasing a new business vehicle. The vehicle costs $ 5 0 , 0 0 0

Current Attempt in Progress

Fink Co is interested in purchasing a new business vehicle. The vehicle costs

$ and will generate delivery revenue of $ for each of the next

years. At the end of the years, the vehicle will have a salvage value of $

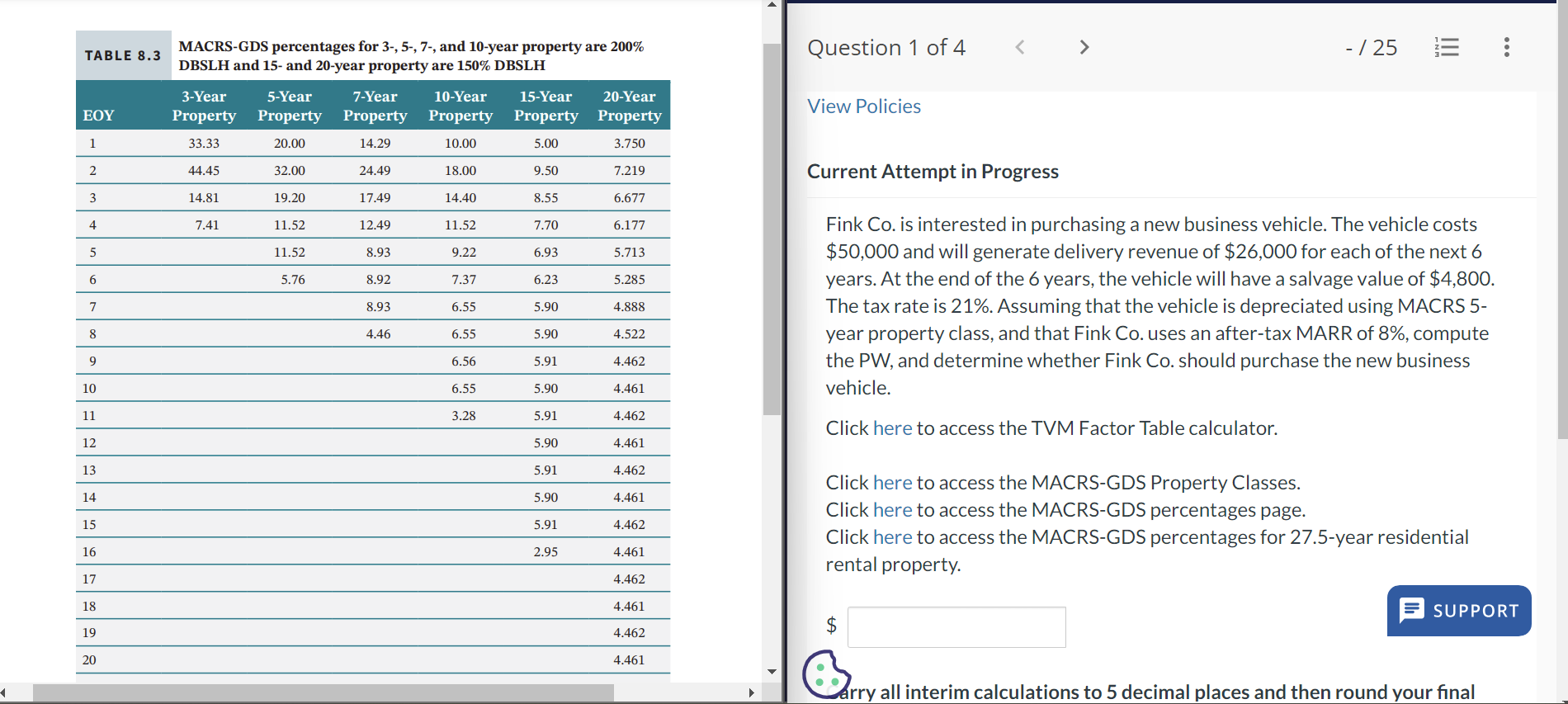

The tax rate is Assuming that the vehicle is depreciated using MACRS

year property class, and that Fink Co uses an aftertax MARR of compute

the PW and determine whether Fink Co should purchase the new business

vehicle.

Click here to access the TVM Factor Table calculator.

Click here to access the MACRSGDS Property Classes.

Click here to access the MACRSGDS percentages page.

Click here to access the MACRSGDS percentages for year residential

rental property.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock